The housing market has shown signs of slowing down, but even so, 73% of metros areas still saw positive price gains in the last quarter of 2025.

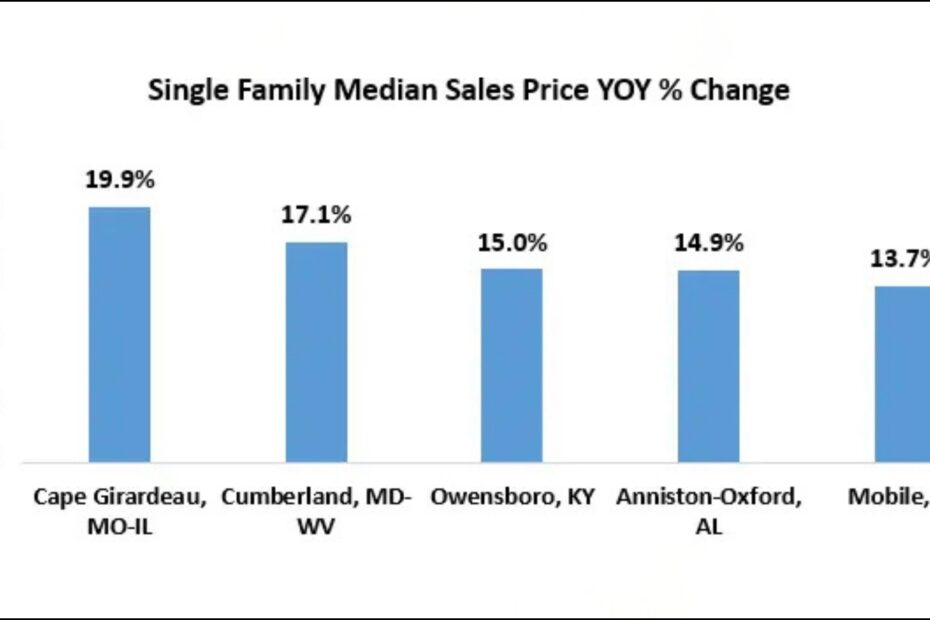

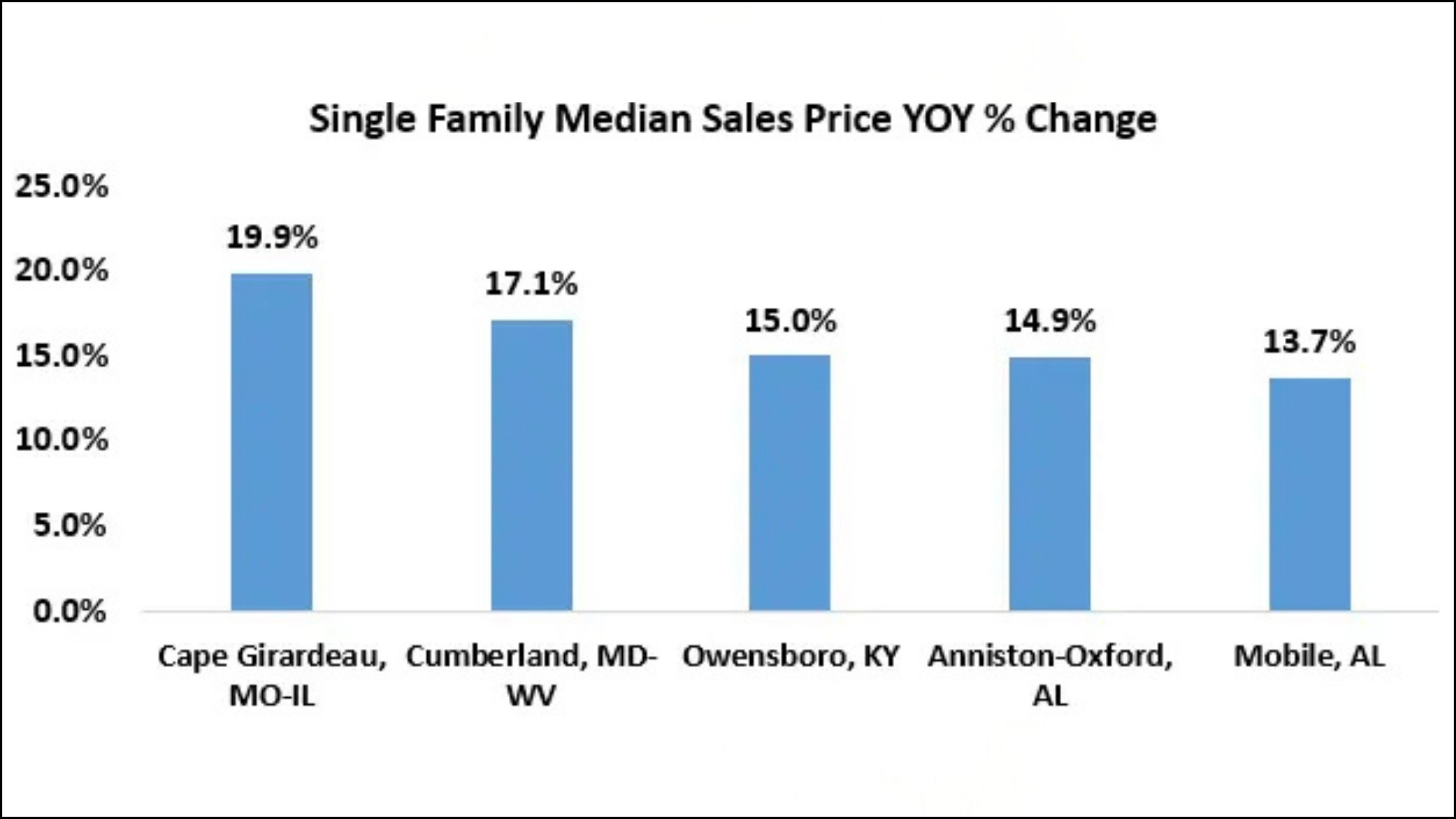

Year-over-year prices grew the fastest in Cape Girardeau in southern Missouri (19.9%), where the median home price is $275,000, according to new data from the National Association of Realtors®.

This was followed by Cumberland, MD (17.1%), where the median home price is $174,900 and then Owensboro, KY (15%), where the median price is $264,000.

In the last quarter of 2025, the national median price rose rose 1.2% to $414,900, even as monthly mortgage payments on a single-family home decreased 5.7% to $2,057, NAR data shows.

These areas fall far below the national median, making them more affordable for the average homebuyer.

“In order to meet the 30% threshold to afford a typical home in the three markets, an annual household income of $53,320 (Cape Girardeau MO-IL), $33,920 (Cumberland, MD-WV) and $51,360 (Owensboro, KY) is needed,” says Jiayi Xu, Realtor.com economist.

The calculation is based on 20% down payment for a first-time buyer at an average 30-year mortgage rate of 6.1%, and excludes tax and insurance.

Prices declined the most in Elmira, NY (-7.2%), Farmington, NM (-7%), and Boulder, CO (-6.7%).

Home price growth has been stalling in many areas, and inflation is falling. That gives buyers leverage, but they still need to come to the market prepared.

“Knowing mortgage rates and qualifying income requirements for down payments will help potential homeowners determine which metro areas are affordable for them,” Michael Hyman writes for NAR.

Price pressure: gradual, not sudden

Xu says some sidelined buyers might be coming back into the market. But homeowner equity remains elevated, which keeps prices steady. Many parts of the country have also seen income growth at a faster rate than home price growth.

“With inventory still relatively constrained, these factors together have contributed to continued price resilience across much of the market despite slower overall sales activity,” says Xu.

So will wannabe homebuyers see any relief in the growth in prices? It might start to look that way. But Xu said to expect affordability gains to come at a slow pace.

“Slightly lower mortgage rates and modest improvements in affordability have brought some sidelined buyers back into the market,” says Xu.

“However, meaningful, longer-term relief for new buyers is likely tied to increasing housing supply, particularly in starter-home segments.

“With inventory remaining tight in many markets, upward pressure on prices is expected to persist even as interest rates ease.”