When people hear that the United States Department of Agriculture offers home loans, many might presume they’d have to buy a farm out in the country to qualify. But that is a common myth about USDA loans.

“The misconception is that anything you’re buying with a USDA loan is in a rural area, on a farm, or it has a silo or a barn on the property, right?” asks Jake Vehige, president of mortgage lending at Neighbors Bank.

“However, that is simply not the case. It’s a program that lets you borrow money. You can finance manufactured homes, you can do single-family residences, you can do townhomes. You have options.”

In actuality, the question of “Where can you live?” when using a USDA loan has less to do with what kind of property you buy, and more to do with where in the country you plan on putting down roots.

But how do you know if a home you’re looking at is in the USDA loan zone and if it has USDA eligibility?

Real estate listings on Realtor.com® typically indicate which homes are eligible for USDA loans. Beyond that, there are a variety of tools and guidelines you can use to verify which homes and areas qualify.

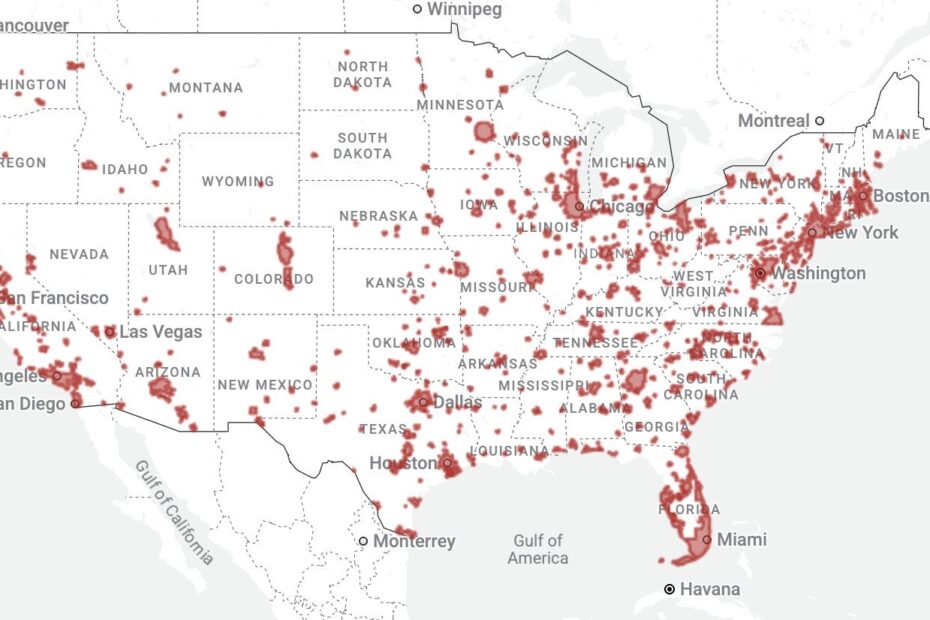

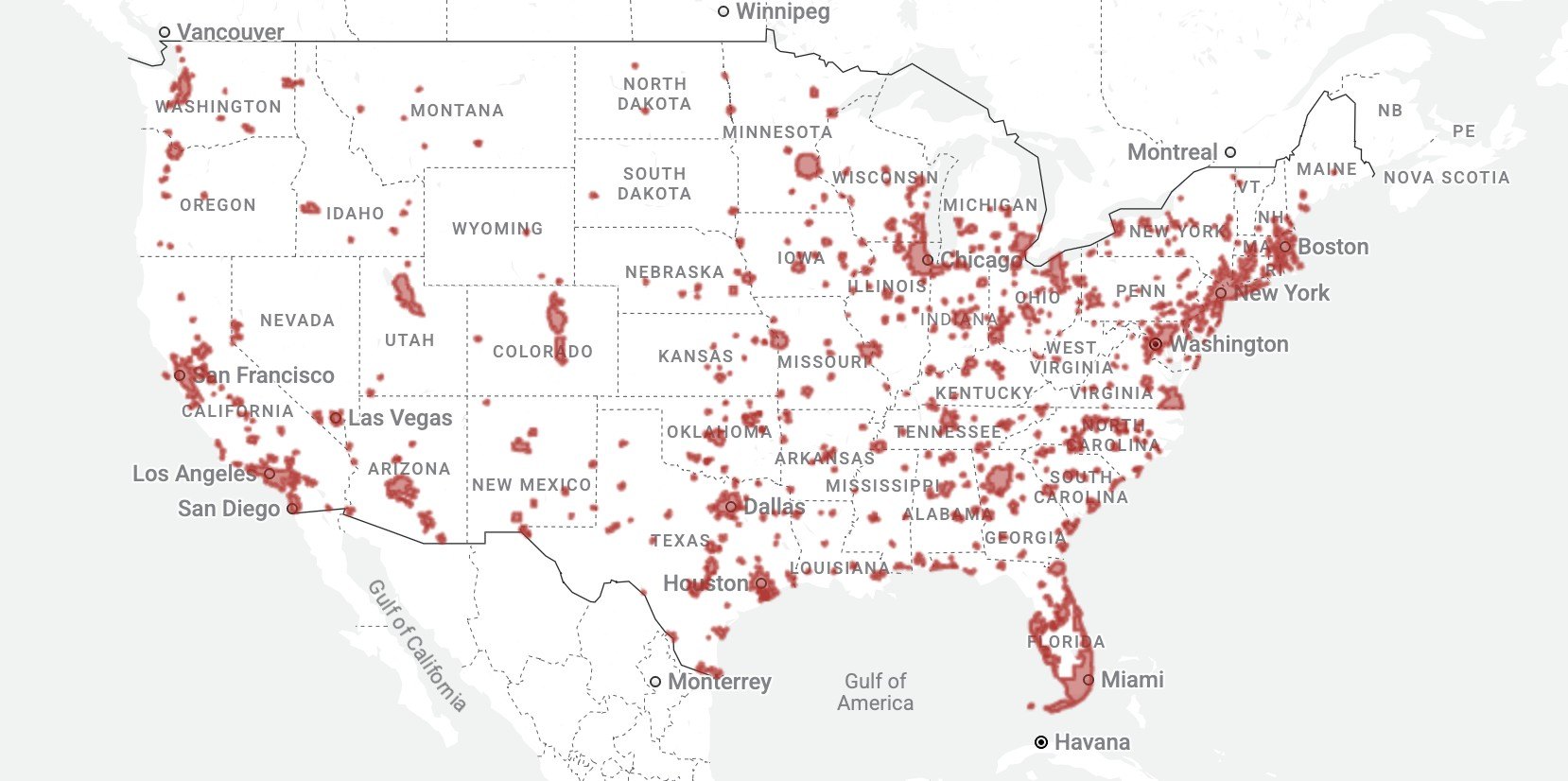

USDA Home Loan Eligibility Map

(Google Maps)

Since one goal of USDA loan programs is to invigorate sparsely populated areas, population size is one criterion for determining whether a home meets USDA loan eligibility.

To be considered rural by the USDA, an area must fall into one of these three categories:

- The area has no more than 10,000 residents.

- If the area has 10,001 to 20,000 residents, it cannot be located in a Metropolitan Statistical Area (MSA). There must also be a serious lack of affordable home loans available for low- and moderate-income families.

- If the area has 20,001 to 35,000 residents, it must have once been considered rural but lost its status in the 1990, 2000, or 2010 U.S. Census. The area must also have a serious lack of affordable mortgage options.

To account for population changes, the USDA typically updates the property eligibility areas yearly.

As you can see, there is a lot that goes into the USDA’s final determination of an area’s eligibility. The criteria mean that many small towns and suburbs fit firmly within the loan requirements.

Check an address to see if it’s eligible for a USDA loan

The USDA website has an interactive map where you can enter an address to check its eligibility and search for USDA loans by state.

If you don’t have an actual address, you can also zoom in on the map to get a sense of which areas are eligible. Shaded areas near cities are off limits, but the lighter areas outside of metropolitan centers are fair game (and make up a good chunk of the map).

You can even magnify the map to identify specific towns and cities that fall within the USDA’s rural definition. This is also a great way to get an idea of which smaller towns, not too far outside of larger urban centers, may qualify. This capability helps potential homebuyers broaden their searches.

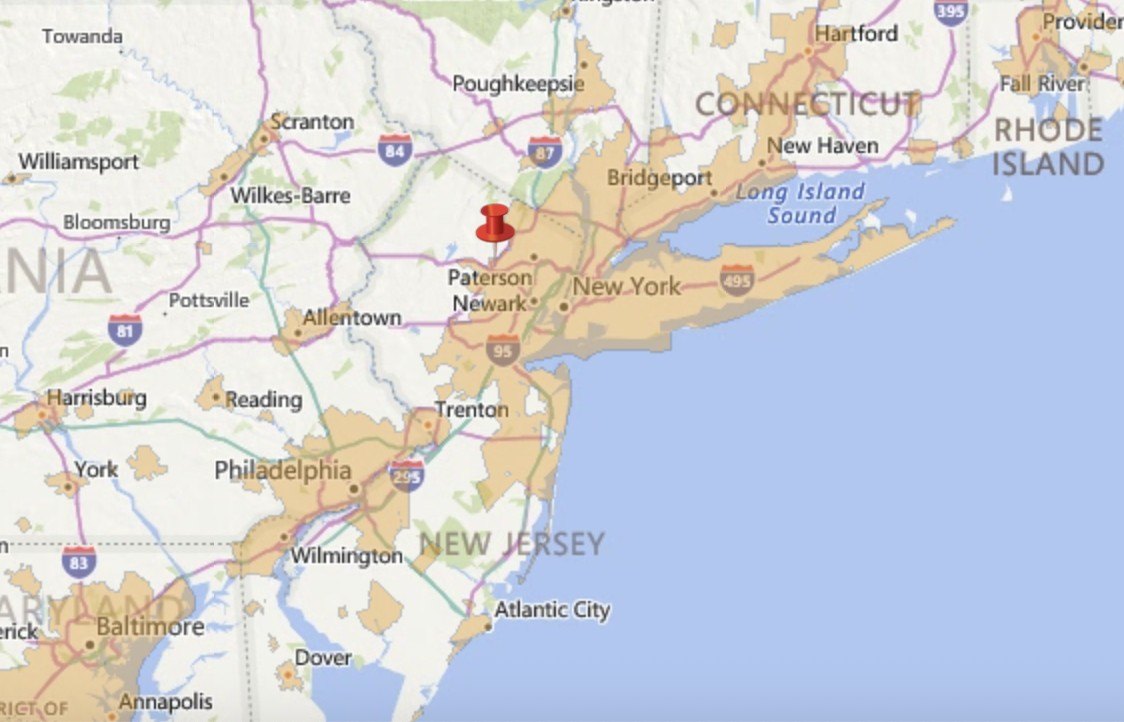

For example, consider this listing in Kinnelon, NJ. The address is roughly an hour away from Midtown Manhattan, easily accessible by bus, train, or even car. According to the eligibility map on the USDA website, this home is in a designated eligible neighborhood.

Ask your lender or real estate agent to help you verify a location

While a USDA eligibility self-assessment can be sufficient, the most accurate alternative to the website is to ask your loan officer.

“Your loan officer can talk to you and guide you through that process,” Vehige explains. In addition to verifying the location, working directly with a USDA-approved lender will speed up the time in getting pre-approval and determining how much you can borrow.

After all, finding a home is really only the first step. The USDA loan process is far easier to navigate with someone on your side.

The bottom line is that a “rural” designation comes from a combined calculation of population and geography. But if you find a USDA-loan-eligible location you like, your new home might be closer than you think.

Dina Sartore-Bodo contributed to this report.