Mortgage rates ticked down on Wednesday as markets awaited the release of more economic data delayed by the government shutdown, and a divided Federal Reserve appeared to be leaning toward another rate cut in December.

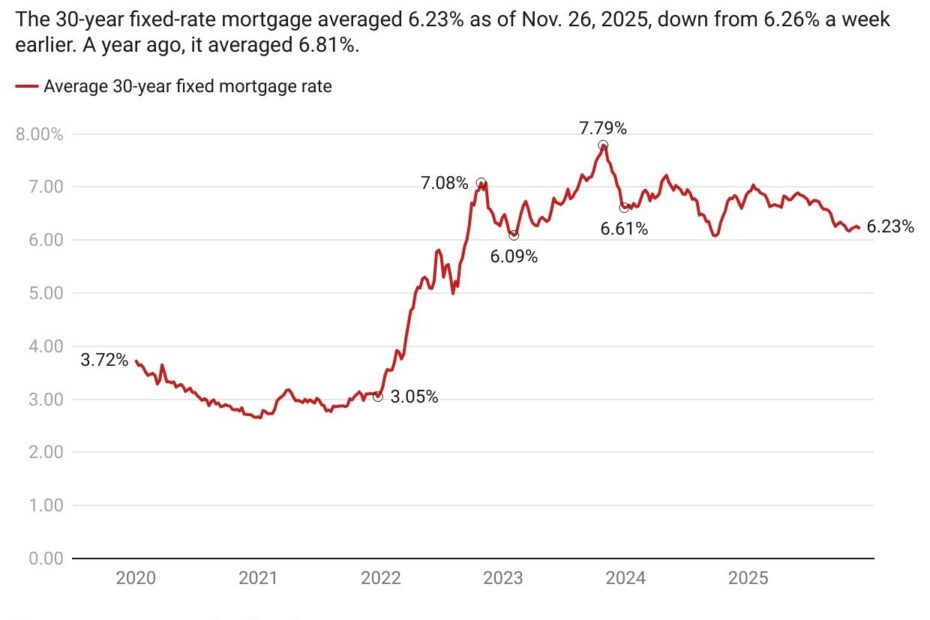

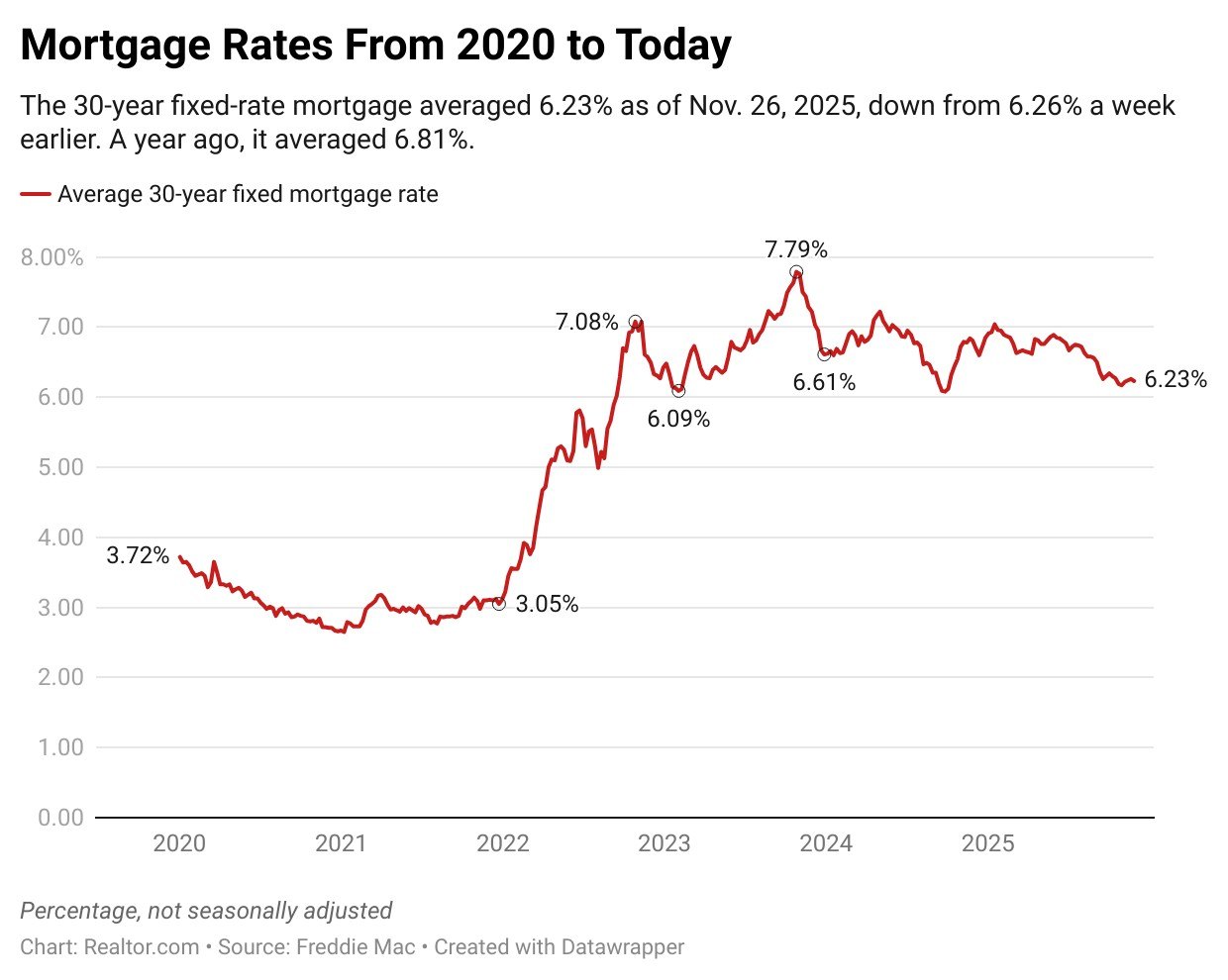

The average rate on 30-year fixed home loans dipped to 6.23% for the week ending Nov. 26, down from 6.26% the week before, according to Freddie Mac. Rates averaged 6.81% during the same period in 2024.

“Heading into the Thanksgiving holiday, mortgage rates decreased,” says Sam Khater, Freddie Mac’s chief economist. “With pending home sales at the highest level since last November, homebuyer activity continues to show resilience as we near the end of the year.”

The slight easing comes after the 10-year U.S. Treasury yield, which mortgage rates closely track, has dipped this week, nearing the 4% mark.

After the stalled September jobs report delivered mixed signals, several Fed key officials, including New York Fed President John Williams, hinted that they would vote for another rate cut at the next Federal Open Market Committee (FOMC) meeting, even despite some likely dissent from fellow policymakers.

Boston Fed President Susan Collins and St. Louis Fed President Jeff Schmid both telegraphed their intention to oppose the year’s third rate cut, citing inflation concerns.

The FOMC will next vote on rate policy on Dec. 10, but key reports on employment and inflation are not expected to be released in time, leaving policymakers to make decisions based on partial and outdated indicators.

A further quarter-point cut to the Fed’s federal funds rate, which traders think will happen with 80% probability, would likely bring mortgage rates down to annual lows just as 2025 comes to a close.

“This would give homebuyers something to be thankful for heading into 2026, while potentially buoying a housing market which has seen some light tailwinds of late,” says Realtor.com® senior economist Jake Krimmel, citing a 1.9% increase in pending home sales in October and four consecutive months of annual growth in existing-home sales.

In more good news for home shoppers, builders have begun to offer more competitive pricing and financing.

“After Thanksgiving, with the fall homebuying season winding down, all eyes will turn back to the Fed and the slow trickle of backlogged government data,” notes Krimmel. “Much of where the mortgage and the housing market is headed depends on the inflation and labor market outlook.”

The economist forecasts that if inflation cools, the labor market rallies, and the Fed delivers another cut, the housing market could enter the new year with “real momentum.”

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors in the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates to fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.