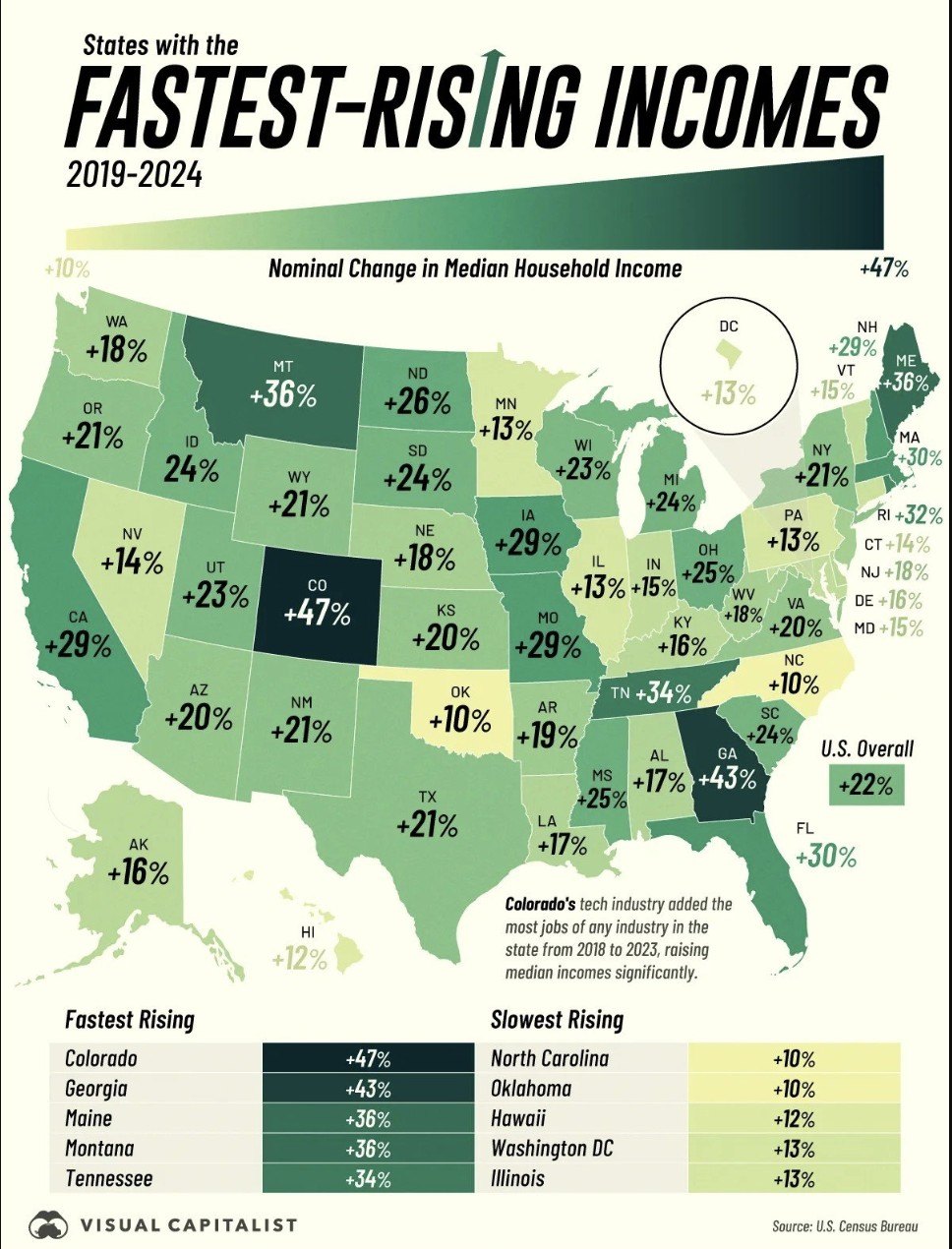

U.S. median household incomes have surged—rising from $68,700 to $83,730 nationally, a 21.9% increase since 2019.

But in some states, salaries spiked even higher. A new study from Visual Capitalist has revealed which states had the fastest rising incomes from 2019 to 2024.

“Where you live matters a lot,” the study noted. “While some states tracked close to the national average, others saw incomes climb at nearly double the pace, driven by booming local industries and major investment.”

Colorado tops the list—with incomes rising nearly 50%.

That dynamic is especially important for homebuyers and sellers, since earning power directly shapes housing demand and pricing.

“Rising incomes increase purchasing power, allowing buyers to qualify for larger mortgages, compete more aggressively, and absorb higher monthly payments,” says Hannah Jones, senior economic research analyst at Realtor.com®. “For sellers, stronger incomes can translate into firmer demand, fewer price cuts, and improved leverage in markets where inventory remains tight.”

Colorado tops the list

According to data from the U.S. Census Bureau, the state that saw the biggest jump was Colorado, where incomes increased by a whopping 46.9%.

“Colorado stands out because income growth has been among the strongest nationally, supported by a high-paying job base and sustained in-migration,” says Jones.

“Home prices surged dramatically during the [COVID-19] pandemic, rising roughly 40% from pre-2020 levels at the peak in 2023. However, price growth has cooled significantly, and home prices sit just about 14% above pre-pandemic levels as of January. This means that households in Colorado are in a good position with strong income growth and home prices well-below their peak level.”

Other states that saw rising incomes

The other states that round out the top 10 are Georgia, Maine, Montana, Tennessee, Rhode Island, Massachusetts, Florida, Iowa, and Missouri.

“Several of these states—such as Colorado, Georgia, Tennessee, and Florida—have experienced strong job growth and in-migration, which tend to lift both household incomes and housing demand simultaneously,” says Jones.

“In more supply-constrained markets like Massachusetts and Rhode Island, income growth often reinforces already high prices because limited new construction prevents inventory from expanding quickly.”

“In Florida, rising incomes definitely help the real estate market. When people earn more, they feel more confident buying a home or upgrading to something bigger,” real estate agent and investor Ron Myers, of Ron Buys Florida Homes, tell Realtor.com.

“I have seen buyers come in with slightly higher budgets than a few years ago, especially people relocating from other states where salaries are even higher. For sellers, rising incomes can mean more move-up buyers. Some homeowners who built equity over the last few years are selling and moving into larger homes or better neighborhoods.”

Robert Dodson, sales manager and broker at Charles Burt Realtors in Joplin, MO, says as incomes increased in Missouri, he saw more people look into investing in rental properties or flip opportunities.

But even as paychecks grow, some people struggle to keep pace with climbing home prices.

“Home price growth has generally outpaced wage growth over the last five-plus years, meaning buying a home demands more income share than before,” says Jones. “If home prices and mortgage rates rise faster than wages, monthly housing payments can increase even when incomes are growing. In many markets, income gains have helped sustain demand, but they have not fully offset the combined impact of elevated home prices and higher borrowing costs.”

Myers agrees: “In Florida, higher income does not always mean homes feel affordable,” he says. “Insurance, taxes, and HOA fees have also gone up. So even if someone is making more money, their monthly costs are still tight.”

Homebuyers and sellers in states with the slowest income growth—North Carolina (up 9.9%), Oklahoma (up 9.9%), Hawaii (up 11.6%), Washington, DC (up 12.6%), and Illinois (up 13.2%)—particularly feel the squeeze.

Top 10 states where incomes are rising the fastest

1. Colorado

Median listing price: $548,900

Median household income 2024: $106,500

Median household income 2019: $72,500

Change in income: 46.9%

2. Georgia

Median listing price: $380,000

Median household income 2024: $81,210

Median household income 2019: $56,630

Change in income: 43.4%

3. Maine

Median listing price: $420,000

Median household income 2024: $90,730

Median household income 2019: $66,550

Change in income: 36.3%

4. Montana

Median listing price: $599,000

Median household income 2024: $81,920

Median household income 2019: $60,190

Change in income: 36.1%

5. Tennessee

Median listing price: $419,023

Median household income 2024: $75,860

Median household income 2019: $56,630

Change in income: 34%

6. Rhode Island

Median listing price: $540,000

Median household income 2024: $92,290

Median household income 2019: $70,150

Change in income: 31.6%

7. Massachusetts

Median listing price: $699,000

Median household income 2024: $113,900

Median household income 2019: $87,710

Change in income: 29.9%

8. Florida

Median listing price: $425,000

Median household income 2024: $75,630

Median household income 2019: $58,370

Change in income: 29.6%

9. Iowa

Median listing price: $269,900

Median household income 2024: $85,480

Median household income 2019: $66,050

Change in income: 29.4%

10. Missouri

Median listing price: $295,000

Median household income 2024: $78,390

Median household income 2019: $60,600

Change in income: 29.4%