In today’s volatile market, a growing number of home purchase agreements are falling apart before reaching the closing table.

Last year, 7.1% of homes fell out of contract and returned to being for sale, according to Realtor.com® economists.

“Deals may fall apart due to financing issues, appraisal gaps, inspection findings, or buyer hesitation as costs change,” says Hannah Jones, senior economic research analyst at Realtor.com. “In a higher-rate environment, even small shifts in mortgage rates, insurance costs, or repair estimates can cause buyers to walk. Longer days on market also give buyers more leverage, and more time to reconsider.”

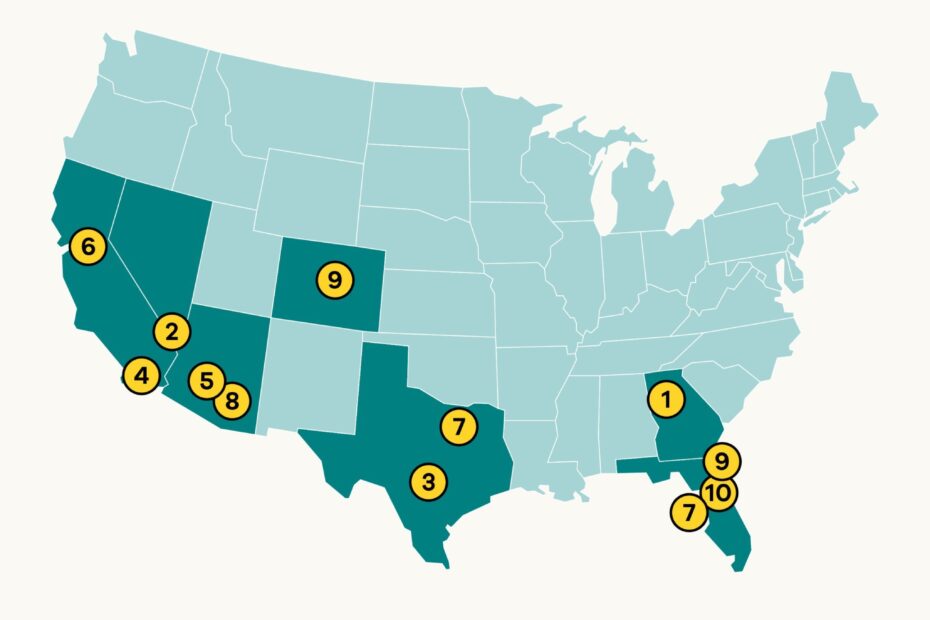

Some areas see far more contract cancellations than others.

Realtor.com recently identified the top 10 metros where the most pending home agreements fell through and were returned to being for sale in December 2025.

The metro that had the most is Atlanta–Sandy Springs–Roswell, GA.

“Atlanta saw very strong pandemic-era demand and investor activity, which pushed prices up quickly,” says Jones. “As the market cools, some buyers may encounter appraisal issues or affordability concerns, especially if they were stretching to buy.”

1. Atlanta–Sandy Springs–Roswell, GA

Median listing price: $400,000

Share returned from pending: 10.3%

“I believe one of the primary reasons for the higher fallout rate in Atlanta is the significant inventory growth,” real estate professional and attorney Bruce Ailion of Re/Max Town & Country tells Realtor.com.

“With buyers having more options and many sellers reducing their price, a higher number of buyers are terminating an agreement when they find a more attractive purchase during their due diligence. The standard Realtor promulgated Purchase and Sale agreement has a due diligence/inspection period that allows for termination for any reason or no reason. When a buyer sees a better opportunity in the due diligence period, they can move on.”

2. Las Vegas-Henderson-North Las Vegas, NV

Median listing price: $465,500

Share returned from pending: 10.1%

“Las Vegas has seen an elevated number of deals falling out of escrow over the last few years, and I believe higher mortgage rates are a major factor,” Robert Little, a real estate agent in Henderson, NV, tells Realtor.com.

“With rates where they are, buyers are much more payment-sensitive, and if they aren’t fully pre-approved upfront, they can end up with sticker shock once they see the real numbers during escrow.”

3. San Antonio–New Braunfels, TX

Median listing price: $320,245

Share returned from pending: 9.6%

“I’ve definitely seen an increase in fall-throughs lately,” Danny Johnson, owner of Danny Buys Houses in San Antonio, tells Realtor.com. “Most of the properties that I’ve seen go back on market in San Antonio are due to surprises found during inspection. Many times, the problem is the foundation. We get a lot of settling here due to the type of soil we have and the droughts we’ve had lately.”

Daniel Cabrera, owner of Sell My House Fast SA TX, says, “One of the properties we have for sale in San Antonio is a renovated property that fell out three times—twice due to the buyer simply changing their minds. The final buyer, however, is staying the course so far.”

4. Riverside-San Bernadino-Ontario, CA

Median listing price: $587,515

Share returned from pending: 9.3%

“Riverside is a more affordable alternative to coastal California, which drew heavy demand during the pandemic,” says Jones. “As affordability has tightened and mortgage rates remain elevated, buyers may be more sensitive to pricing and financing constraints.”

5. Phoenix-Mesa-Chandler, AZ

Median listing price: $482,500

Share returned from pending: 9.2%

“I had 11 homes fall out of contract last year, which is double any other of my 14 years in the real estate industry,” Stacy Miller, of Re/Max Fine Properties in Phoenix, tells Realtor.com. “Buyers are able to be so much pickier; with approximately 25,000 listings on the market, that’s more than double a pretty even buyer/seller market.

“Buyers also need to be more picky with the costs of ownership so high. Some reasons my buyers have canceled their home purchase have been homeownership costs and inspection issues more than anything.”

6. Sacramento-Roseville-Folsom, CA

Median listing price: $599,990

Share returned from pending: 9.1%

According to real estate broker Maurice Thomas, president of the Sacramento Association of Realtors®, most pending homes fall out of escrow in Sacramento for two main reasons.

“The main reason is that the loan doesn’t go through and finance the home,” Thomas tells Realtor.com. “It could be for a variety of reasons: a lack of down payment; interest rate changes if the rate isn’t locked in; or something happens with employment, like sudden credit changes, et cetera.”

“This is why it’s very important to speak with a Realtor. They have trusted loan officers they use with a great track record to get your loan to the finish line. The second reason is that something happens with the inspection. A strong Realtor will give you expert advice to guide you through this esoteric process.”

7 (tie). Dallas–Fort Worth–Arlington, TX

Median listing price: $412,500

Share returned from pending: 8.9%

Todd Luong, an associate at Re/Max DFW Associates V, tells Realtor.com, “Over the past several months, we have seen a noticeable increase in pending home sales falling out of contract here in the Dallas-Fort Worth market.

“Low appraisals are contributing to more deals falling through. When a home doesn’t appraise for the sales price, buyers are often asked to bring additional cash to closing. In the current environment, many buyers are unwilling to do that, especially when there are other homes available at similar price points.”

7 (tie). Tampa-St. Petersburg-Clearwater, FL

Median listing price: $399,900

Share returned from pending: 8.9%

“Florida markets have been hit by a combination of rising insurance costs, HOA fees, and property taxes, which can materially change a buyer’s monthly payment late in the process,” says Jones. “That sticker shock can derail deals after contracts are signed. Florida also saw rapid price growth during the pandemic, increasing the risk of appraisal gaps.”

8. Tucson, AZ

Median listing price: $380,000

Share returned from pending: 8.8%

James Sanson, the strategic real estate adviser at Real Estate Bees, tells Realtor.com, “In Tucson, I have seen an increase in escrow fallout from pending escrows based on inspection results. I have seen both instant cancellations and requests made for extreme items, and the sellers rejecting and then canceling.”

9 (tie). Denver-Aurora-Centennial, CO

Median listing price: $557,500

Share returned from pending: 8.7%

Real estate agent Jim Merrion of Coldwell Banker Realty tells Realtor.com, “In Denver, the main reason homes have been falling out of contract over the past 12 months is due to a disconnect between what the buyer and seller value their property at.”

“We see terminations arise as a result, mainly during inspections, when the buyer asks for quite a bit more in compensation than the seller expects or is comfortable paying. The seller likely feels they were already beaten up over the offer price and now they are being asked to throw more money at the buyer to address inspection items.”

9 (tie). Jacksonville, FL

Median listing price: $382,500

Share returned from pending: 8.7%

Cara Ameer, a real estate agent with Coldwell Banker in Florida, tells Realtor.com, “Many times when a contract falls through in Jacksonville, the buyer gets cold feet because of the total costs involved—including mortgage, property taxes, insurance, HOA or condo dues, and moving fees. When buyers start to see all of this laid out on paper, they start realizing that buying was going to be much more expensive than they realized.”

10. Orlando-Kissimmee-Sanford, FL

Median listing price: $415,500

Share returned from pending: 8.6%

“I’m seeing more pending deals fall through in Orlando,” real estate agent and investor Ron Myers of Ron Buys Florida Homes tells Realtor.com. “One of the biggest reasons is homeowners insurance. Once buyers get their quotes for some of the older homes or those with roofs over 10 years old, they’re shocked at the cost. That extra monthly payment can be the deal-breaker.”

Myers says inspections are another common issue. “A lot of these homes have older plumbing, electrical, or roofs, and buyers don’t want to take on the repair costs,” he explains. “If sellers aren’t willing to fix things or drop the price, buyers walk.”