Existing-home sales disappointed in January, but is the chilly start to the year a sign of what’s ahead? We saw two key macroeconomic indicators this week: the jobs report and inflation measured by the consumer price index (CPI).

In the January jobs data, we saw a revision that brought the average payroll job growth in 2025 to just 15,000 per month (down from nearly 50,000). The sizable downward revision was widely expected, so while large, it wasn’t a shock.

More surprising was the improvement we saw. The unemployment rate dropped from last month as employers added 130,000 jobs—nearly nine times as many as the typical month in 2025. Average hourly earnings also rose (3.7%—in line with last month). On net, the jobs report was one of this week’s relatively good signals.

Meanwhile, inflation fell in January, registering 2.4% overall and 2.5% for “core” inflation, a subset that excludes noisy food and energy prices and is often considered a good gauge of underlying price pressure.

Although still above target, core inflation is at its lowest level since March 2021. Taken together, neither the job nor inflation data was enough to shift market expectations that the Federal Reserve will leave its policy rate unchanged in March, but it’s encouraging to see both of these key indicators moving in the desired direction.

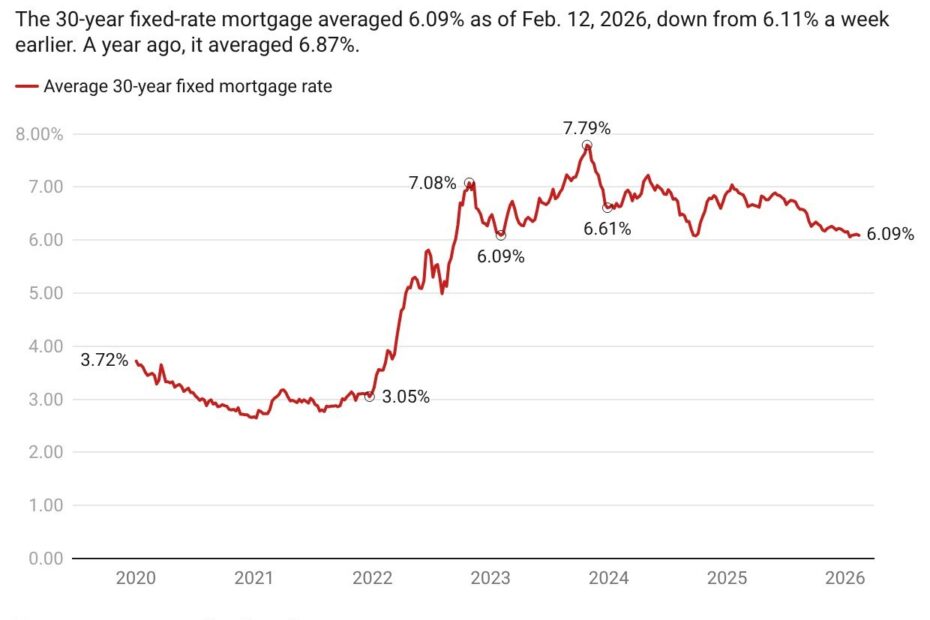

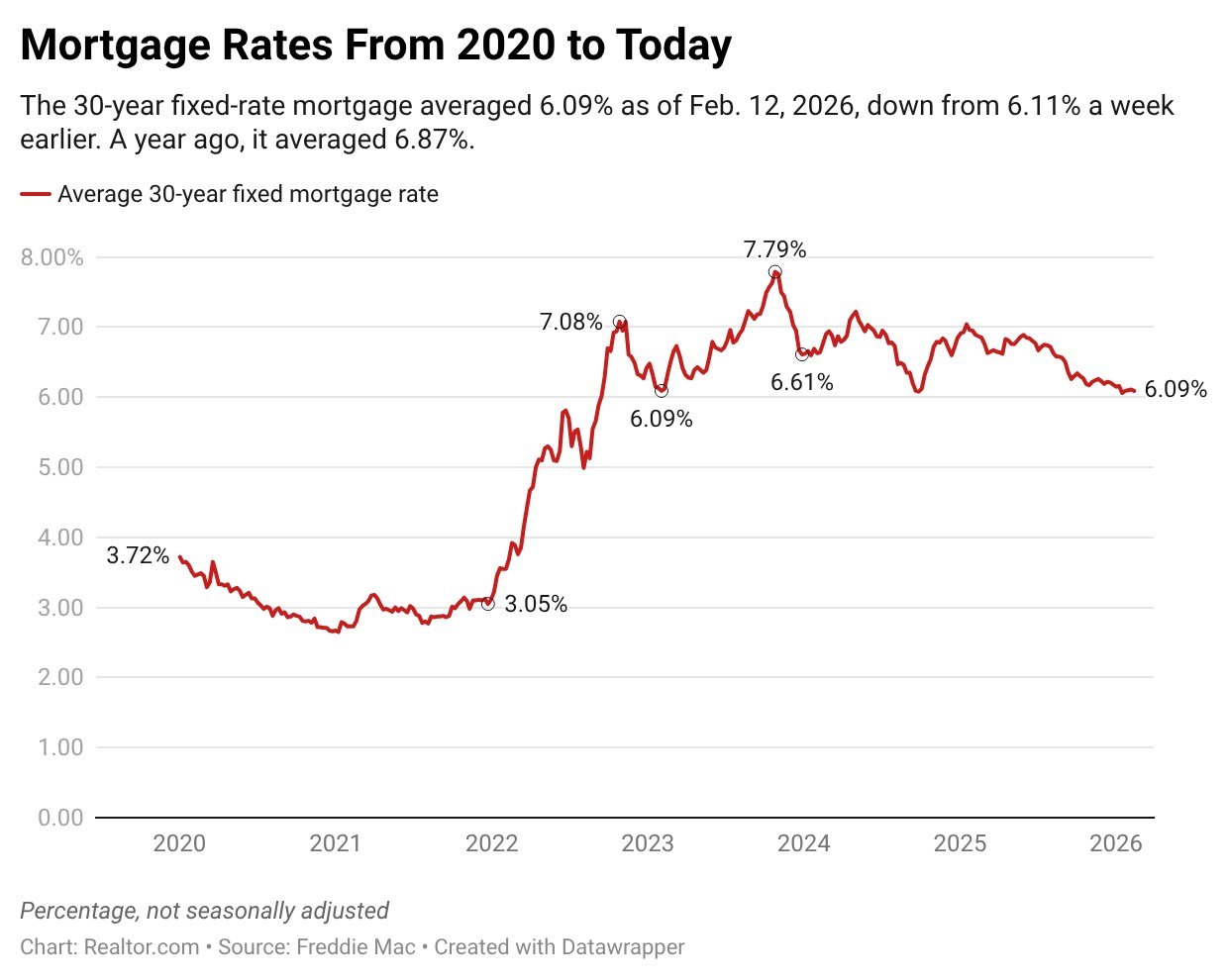

Mirroring the steadiness in monetary expectations, mortgage rates were once again quite steady, ticking down 2 basis points and notching a seventh straight week in the narrow range just above 6%. This bodes well for the upcoming spring buying season for homebuyers and sellers.

But it’s worth noting that recent housing data has been a mixed bag, at best.

January existing-home sales were disappointing, dropping from both the prior month and prior year to a 16-month low. Severe winter weather undoubtedly played a strong role, but the weakness was spread across all four regions and December pending home sales were also weak, so it’s not just weather. Home sales are backward looking, however, and there are still some reasons for optimism including those steady mortgage rates.

Looking at Realtor.com ®weekly housing data, we see some improvement from last week’s snow battered new listings, but they still lagged the prior year suggesting that sellers got a slow start. This hampered overall listings growth, which slowed. Interestingly, asking prices remain relatively soft, and this theme carries through two additional Realtor.com reports this week.

According to the latest New Construction Insights report, the listing prices of both new and existing homes were relatively steady in the fourth quarter of 2025. Additionally, the report showed that nearly 1 in 5 new homes cut prices, more than in the resale market for the first time in recent years.

This is not just a reflection of price weakness in the West and South where many new homes are built. It suggests that builders are competing more directly on price to keep sales moving, even as the median asking price itself remains relatively stable.

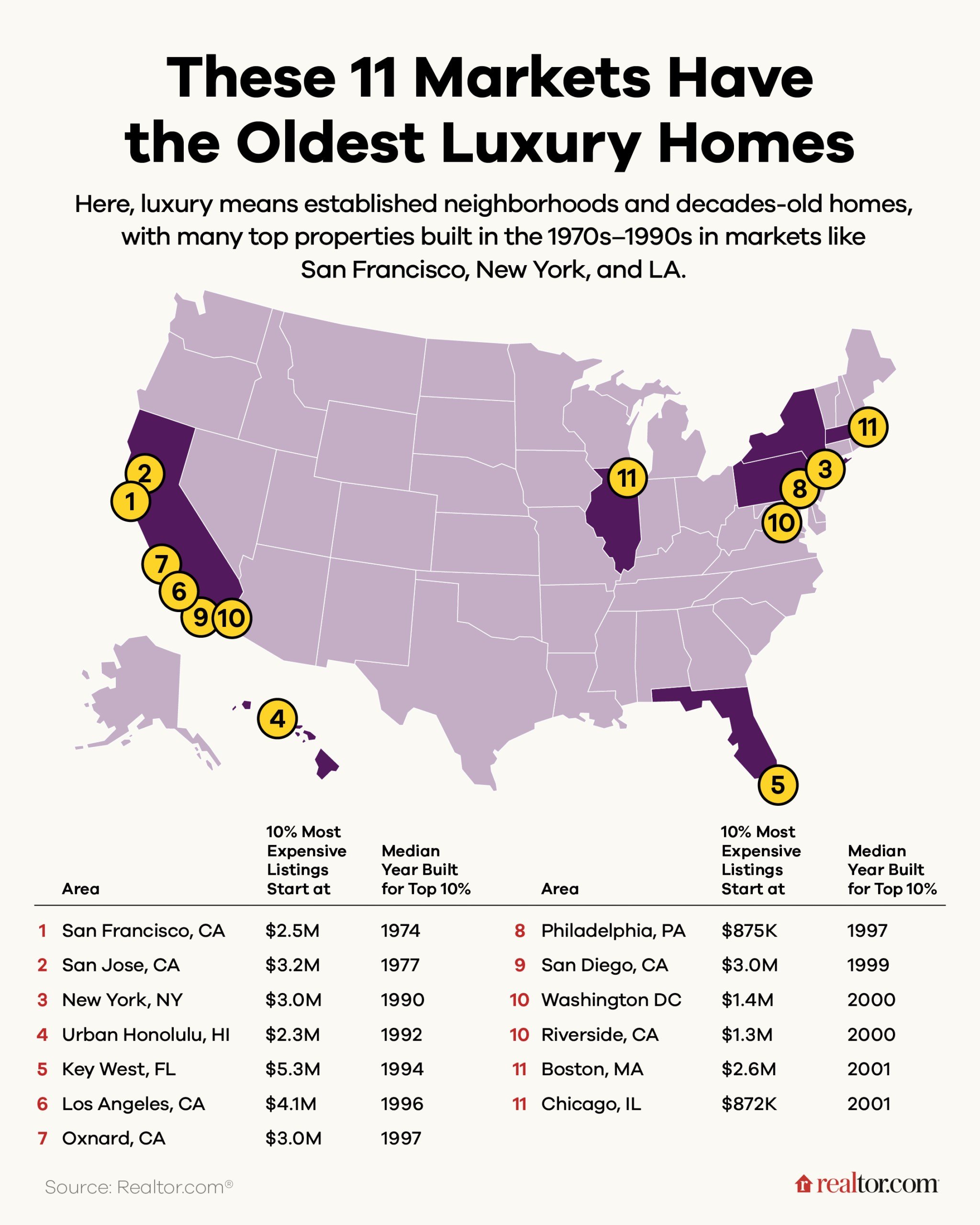

The January Luxury Trends report showed that the high-end market began the year on softer footing rather than a bang as well, with luxury prices trending slightly lower. The report also compares old and new luxury markets, finding legacy homes on the coasts skew smaller while newer luxury markets—many in the South—offered buyers more space for the money.

Finally, the January Hottest Markets report found that Kenosha, WI, earned the top spot with the typical home in the city showing strong demand; it had more than three times the page views of the typical home nationwide.

Among the 40 largest markets, fellow Midwesterner Kansas City, MO, saw the biggest jump in the last year suggesting that real estate markets remain more competitive for buyers in the Midwest than in many other areas.