Prices for existing homes will likely fall in many cites this year, as individual sellers respond to price pressure from homebuilders cutting prices, according to a top economist specializing in residential construction.

Speaking at the International Builders Show in Orlando, FL, on Tuesday, National Association of Home Builders Chief Economist Robert Dietz said he expects home prices to falter in much of the country as the resale market adjusts to price competition from new builds.

“We expect in most markets this year, resale prices to go down in order to improve affordability conditions, because existing homeowners now have to do the price discovery that builders have been doing since 2022, and they haven’t done it yet,” Dietz said.

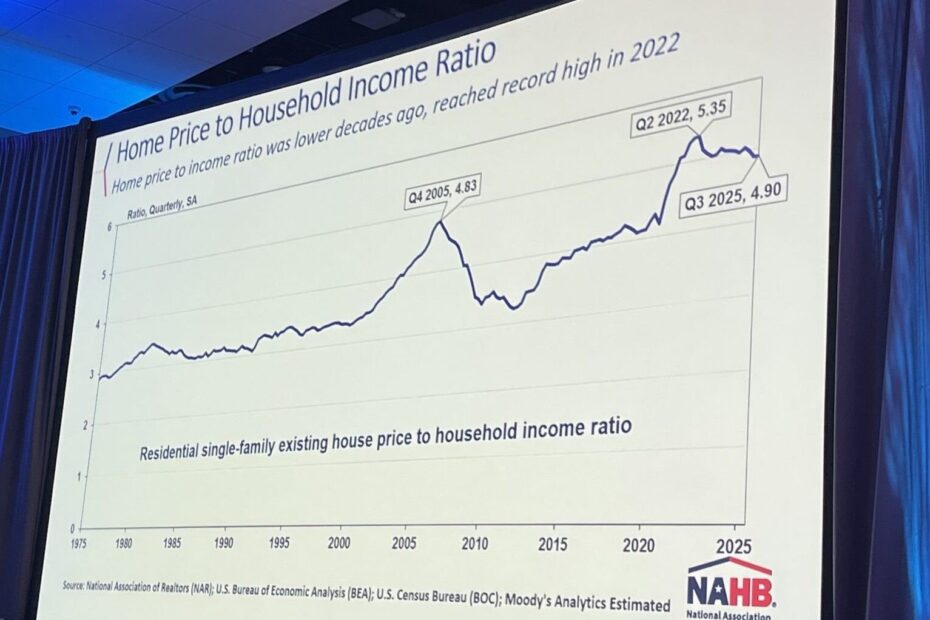

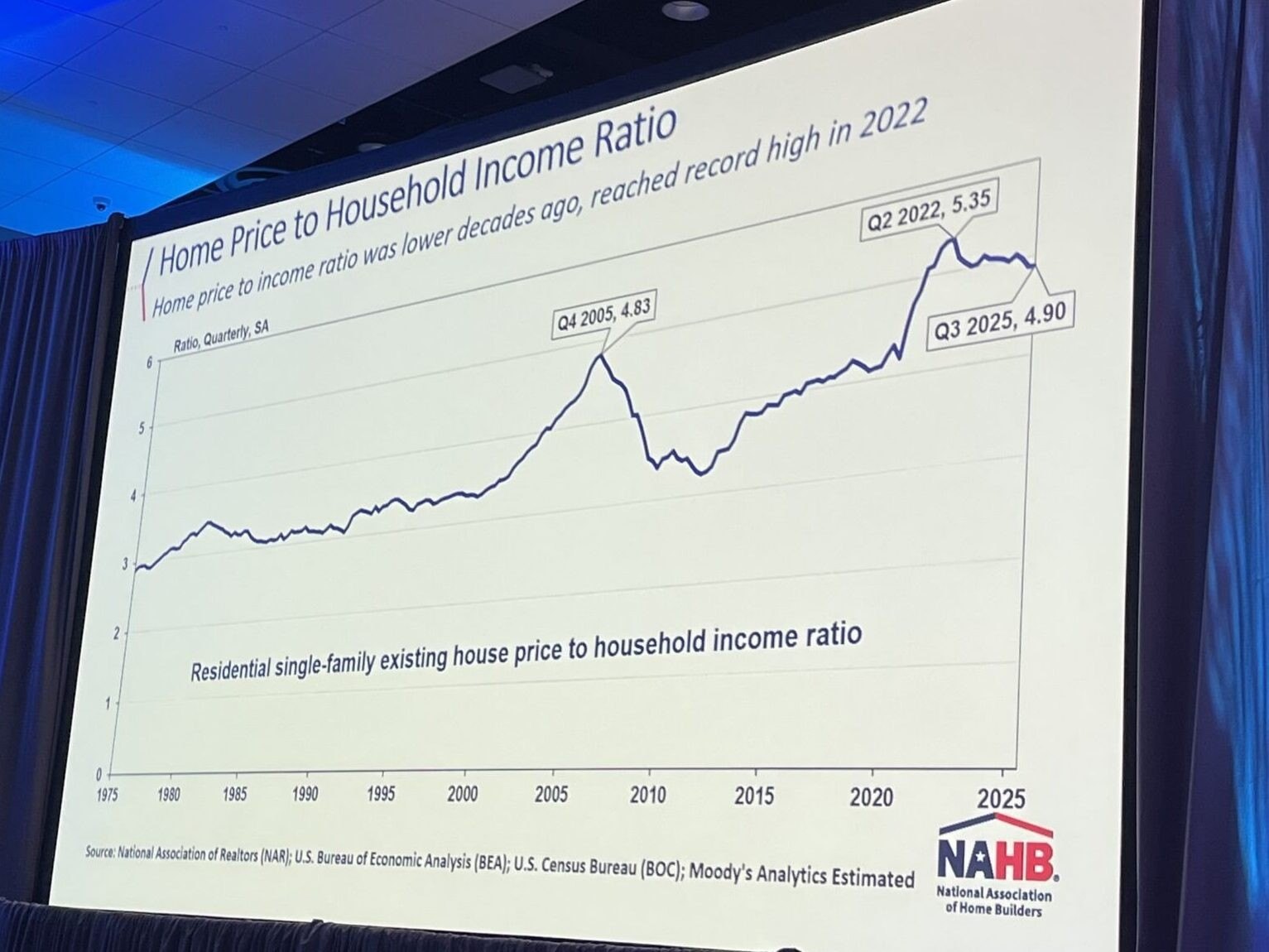

“So we think that’s happening in 2026 and of course, it’s needed, because when we look at the home price to income ratio. This, to me, sums up the affordability challenge,” the economist added, showing a chart indicating that the typical home price is 4.9 times higher than the typical income.

That’s well above the long-term historical average of around 3x income, and even higher than the 4.83x ratio reached in 2005 during the peak of the housing bubble.

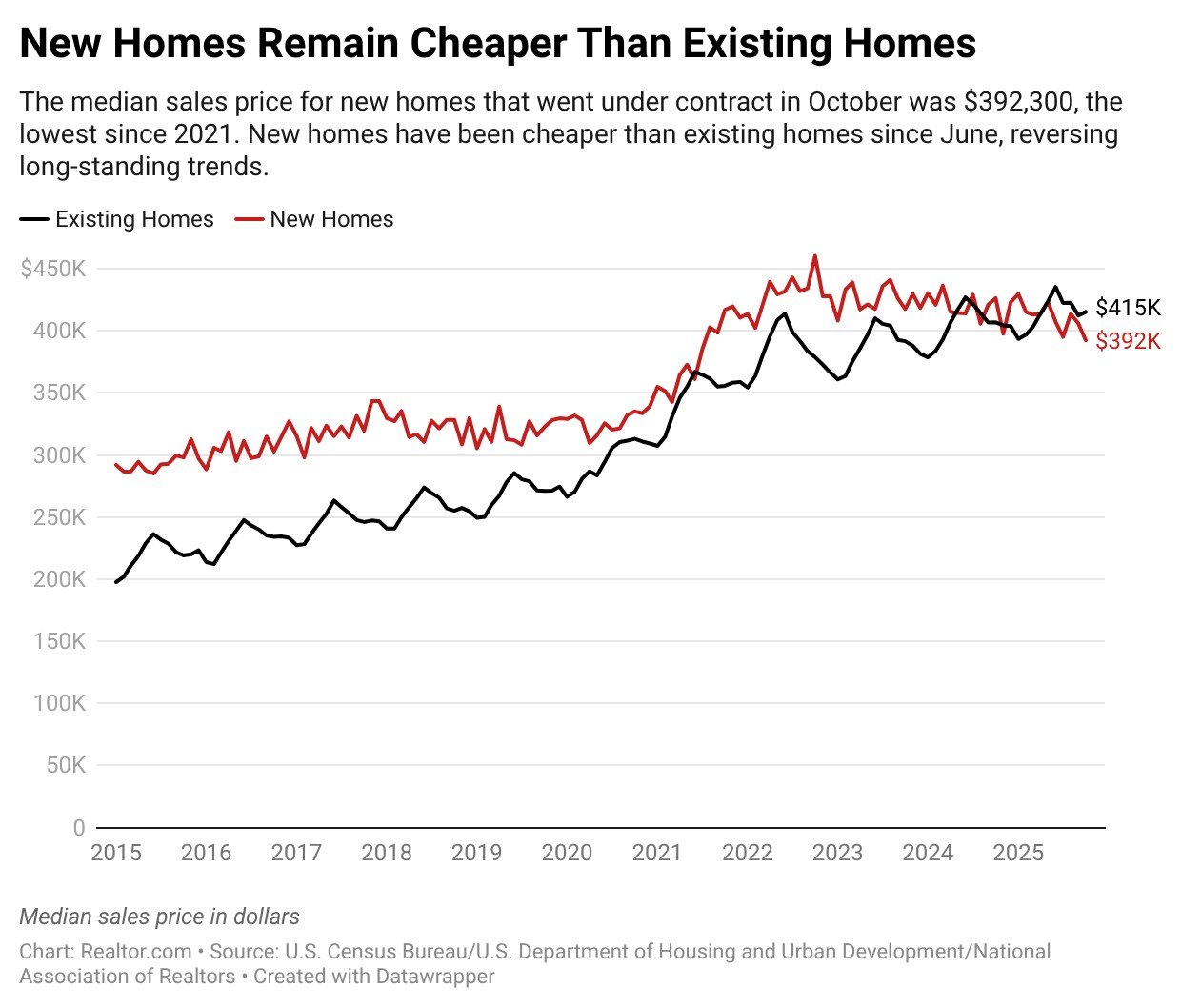

However, Dietz pointed out that prices for newly built homes have been trending lower for three years, with the typical new build now about 15% cheaper than in the fall of 2022.

Homebuilders have slashed prices in response to a weak market, with affordability challenges one of the key factors weighing on demand. But so far, individual home sellers have been much more reluctant to cut their asking prices.

A recent Realtor.com® analysis found that, for the first time in recent history, new homes are more likely than previously owned homes to carry a price cut.

In the fourth quarter, 19.3% of listings for new builds offered price reductions, compared with just 18% of existing homes, according to the Quarterly New-Construction Insights report.

As well, the median new home sales price has actually been lower than that of existing homes since April 2025, inverting long-standing trends. (To understand how strange this is, consider a car dealer that charged more for used cars than new cars of a similar make and model.)

According to the economist Dietz, part of the price relief for new construction has come from slightly smaller home sizes, with the typical floor plan about 5% smaller than in 2022. But the bulk of the decline is due to price cuts and discounts, he says.

While individual home sellers have been reluctant to let go of their peak pricing expectations from the height of the pandemic buying frenzy, the economist Dietz says he expects that to change in 2026.

“Historically, home prices to incomes, the 3 to 1 ratio, that was a well-understood rule of thumb that had been around for a while,” he says. “When the price-to-income ratio is 5 to 1, it’s harder for those younger households to save up, whether it’s the 3.5% for an FHA mortgage or a 10% down payment on a conventional mortgage.”

Not all economists agree prices will fall

Realtor.com Chief Economist Danielle Hale also spoke at the homebuilder conference in Orlando, where she reiterated her forecast that home prices will rise modestly in 2026.

“Looking at asking prices, our expectation is that they’ll be up slightly for the year,” Hale told the audience at the Orange County Convention Center.

Hale noted that asking prices for homes were roughly flat in January compared with a year earlier, although sales prices ticked slightly higher, reflecting persistent competitive conditions in the housing market, particularly in the Northeast and Midwest.

Meanwhile, the share of listings with price reductions has declined in recent months. “That suggests to me that sellers are pricing right upfront and trying to avoid having to make asking price reductions as they move to 2026,” says Hale.

Still, market conditions vary dramatically depending on region, with soft markets and falling prices in the South and West, and hotter markets and rising prices in the Midwest and Northeast.

“It’s a pretty wide range, and there’s more regional bifurcation than we typically see in the housing market because of the varying inventory conditions that we’re seeing in these different markets across the country,” says Hale.