In a market already strained by rates and prices, homeowners insurance costs are creating a new divide.

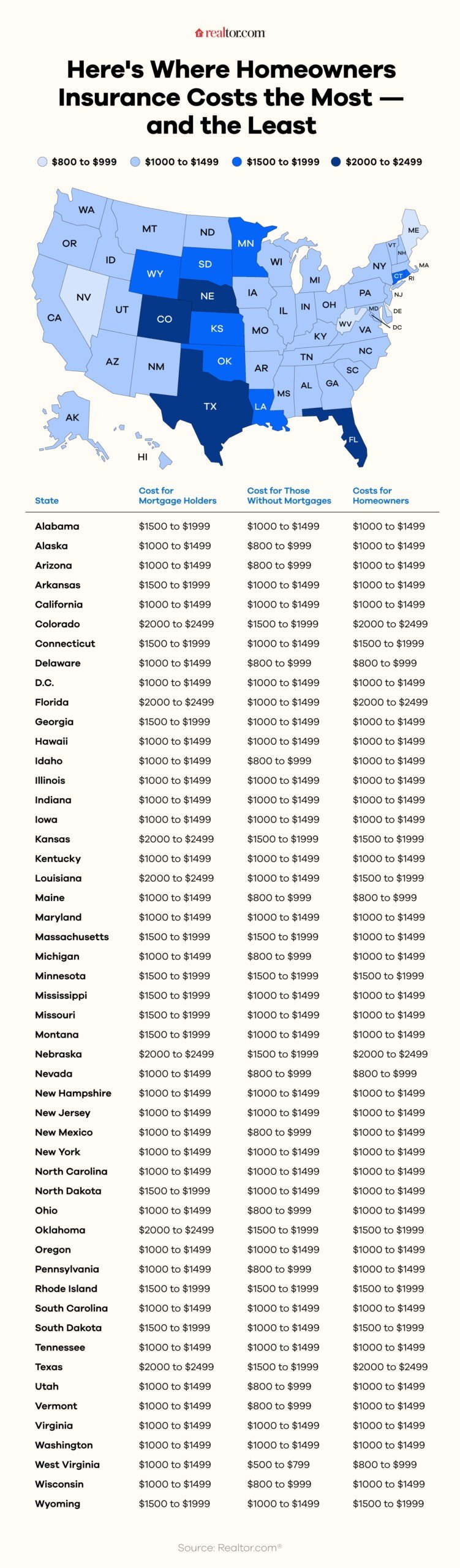

In 2024, homeowners in Colorado, Nebraska, Texas, and Florida paid the highest insurance costs in the nation, according to newly released American Community Survey (ACS) data from the U.S. Census Bureau. In these states, homeowners carried policies with a median annual cost of $2,000 to $2,499.

The data backs up recent findings from the Realtor.com® Housing and Climate Risk Report, which found homes in five Florida metropolitan areas rank among the top 10 markets with the highest insurance burdens.

Premiums were generally higher for mortgage holders, who paid $1,500 to $1,999 per year, compared with homeowners without mortgages, whose median costs often fell between $1,000 and $1,499.

While these numbers may seem paltry compared to premium averages that can stretch into the tens of thousands of dollars, what’s striking is that these are median values—underscoring just how widespread these high costs have become.

Median values are a better measure than averages because they aren’t skewed by extreme outliers. While a few ultraexpensive policies can push the average much higher, the median reflects the midpoint—what a typical homeowner is actually paying. That makes it a more reliable indicator of how widespread affordability pressure really is.

And as insurance costs climb, so do the consequences. These rising premiums are directly shaping where people can afford to buy, how they plan for long-term homeownership, and whether they can keep their homes protected at all.

“Insurance costs are increasingly shaping affordability, especially in this high-rate, high-priced environment,” says Realtor.com senior economist Jake Krimmel. “It’s just another added, and quite necessary, cost for owning today and moving forward.”

Why insurance costs matter

Homeowners insurance is a critical financial safeguard that protects what is often a family’s most valuable asset. Yet, as premiums spike and more insurers pull out of high-risk markets, more Americans are considering going without it. One in seven homes is currently uninsured, and more than half of homeowners (58%) say they’d drop their insurance if the price got too high, a new survey from Realtor.com finds.

But for mortgage holders, it’s not an option. Lenders often require a policy to carry a mortgage, despite these homeowners also carrying the highest median costs. In seven states—Colorado, Nebraska, Texas, Florida, Kansas, Oklahoma, and Louisiana—policyholders with a mortgage can expect a median annual insurance premium of $2,000 to $2,499, while the highest median costs for those without a mortgage was just $1,500 to $1,999.

“It’s hard to tell what drives the big differences between the costs for mortgage holders and non-mortgage holders,” says Krimmel. “But part of the story could be that mortgage holders tend to be younger and may have recently bought more valuable properties. Higher property values or more expensive locations alone could account for a large part of this difference.”

The divide underscores just how vulnerable homeowners can be—especially in the early, fragile years of building equity. The cost of owning a home has surged nearly 30% over the past five years. While some homeowners without a mortgage may choose to take the risky gamble of dropping insurance to keep costs down, those with mortgages don’t have that option. They’re required to maintain coverage—and must find ways to absorb the rising burden.

The most expensive states for home insurance

For all homeowners, Colorado, Nebraska, Texas, and Florida are where homeowners paid the most for insurance, with median annual premiums often surpassing $2,000. Kansas, Oklahoma, and Louisiana join the ranks when looking just at mortgage holders.

Florida tops the charts in more ways than one: In addition to carrying the highest median premiums, it also has the dubious honor of having the most homeowners paying over $4,000 per year (the highest range measured by the ACS).

These top-tier states have one thing in common: exposure to extreme weather and natural disasters that make coverage both riskier and more expensive.

“Disaster risk varies widely by geography, with coastal areas obviously susceptible to hurricane-related damage a prime example,” explains Krimmel. “But flood risk extends into the heartland, too, especially for properties located near rivers and their flood plains. This is not to mention tornado alley in the Plains or wildfire risk on the West Coast.”

Krimmel adds that regulatory environments also play a key role.

“The California government, for example, is stepping in to try to control costs directly. The flip side of this, unfortunately, is it can cause insurers to exit the state or for them to rely on policyholders in other less-risky states to effectively cross-subsidize California’s climate risk.”

The more affordable states

Homeowners in the Northeast, Midwest, and parts of the West continue to see more manageable premiums. States such as Ohio, Pennsylvania, Wisconsin, Vermont, and New Hampshire reported median insurance costs well below the national high, ranging between $800 and $1,500 annually—less than half what some Florida homeowners pay. These regions are generally spared from the most extreme natural disasters, which helps keep claims and premiums down.

For buyers, that can make a real difference. Lower annual insurance costs mean lower overall carrying costs, which can tip the scales when evaluating where—and what—you can afford to buy. Even if home prices in these states aren’t the absolute lowest, the reduced monthly outlay on insurance makes them more financially sustainable in the long run, especially for first-time buyers or retirees on fixed incomes.

In today’s market, affordability isn’t just about the sticker price of a home. It’s also about the ongoing costs of ownership—from mortgage payments to utilities, taxes, and insurance. And in states where premiums are still relatively modest, buyers may find it easier to weather the economic storms ahead.

What buyers and homeowners should know

Home insurance costs aren’t determined just by your state—they’re also shaped by hyperlocal risks such as wildfire zones, flood plains, and storm corridors. That means premiums can vary significantly even within the same ZIP code, depending on the property’s location, construction, and claims history. Buyers considering a home in a high-risk area may be surprised to find the insurance bill rivals—or even exceeds—their property taxes.

“It’s one thing for insurance to be high in high-priced areas like Los Angeles, where affordability is already strained, but it’s another for Nebraska homeowners to be paying among the highest premiums in the nation,” says Krimmel. “Incomes and cost of living are much lower, so paradoxically, the traditionally more affordable places might be hit harder on the margin by rising insurance costs.”

Because of that, insurance should be part of every affordability calculation. While most buyers focus on mortgage rates and home prices, skipping the insurance quote can lead to financial shocks after closing.

While only 30% of buyers have researched natural hazard data for a home they’ve purchased or considered, and only 44% plan to, this promises to become one of the most essential steps of home shopping.