Former Freddie Mac CEO Donald Layton has offered a blunt critique of the Trump administration’s main proposals to lower mortgage rates through policy changes at Fannie Mae and Freddie Mac.

In a virtual forum Tuesday, Layton addressed the administration’s key plans for using Fannie and Freddie to cut mortgage costs, including by buying up mortgage bonds, slashing guarantee fees, backing assumable or portable mortgages, and offering 50-year mortgages.

Layton, who led Freddie Mac from 2012 until 2019, was sharply critical of those big-ticket ideas, arguing that the two government-sponsored entities (GSEs) are poorly suited to solve the housing shortage at the root of the affordability crisis.

“If you’re in the administration, [and] you want to do things at the federal level about supply, the GSEs better not be at the heart of your effort, because they’re not well positioned,” he said. “The optics is good, but real impact, it’s going to have to be elsewhere. It’s going to have to be more supply side oriented, either at the state and local level or the federal level.”

Speaking with Mark Willis, a senior policy fellow at the NYU Furman Center, Layton noted that Fannie and Freddie are demand‑side tools designed to provide liquidity and stability to the mortgage market.

By purchasing and packing mortgages for investors, the GSEs ensure a steady supply of loans and provide “more firepower” to homebuyers through better mortgage terms, says Layton.

However, he argues the current housing affordability crisis clearly stems from insufficient housing supply, not just borrowing costs. That echoes an analysis from the Realtor.com® economic research team finding that the nation has a housing shortage of roughly 4 million units.

“If you look at the charts of how many homes have been built in the last 50 years, it’s completely obvious that this is a supply-side problem,” he said. “GSEs are not supply-side entities, so they’re kind of not at the core of the problem.”

Layton addresses key proposals to reduce mortgage payments

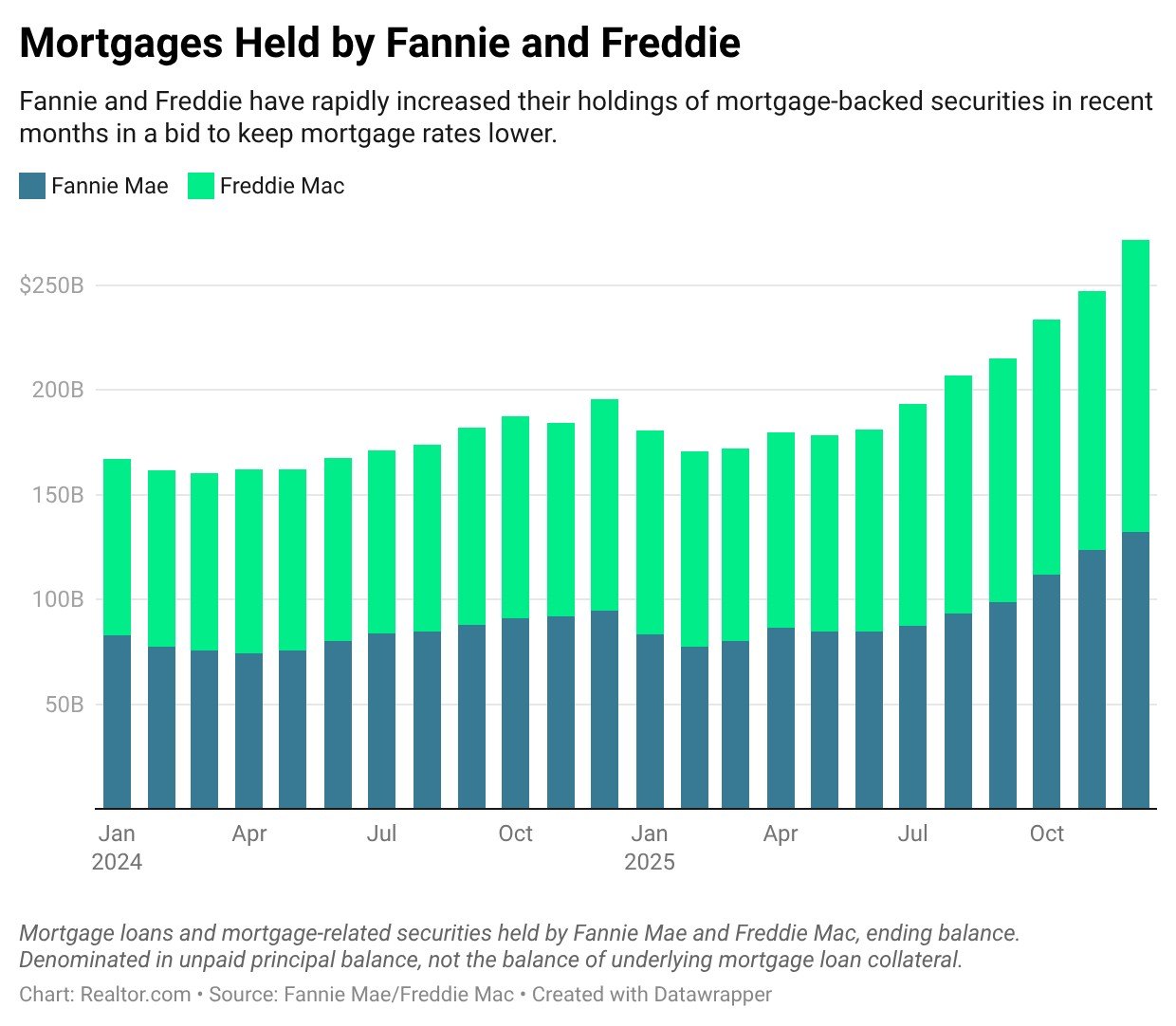

Against that backdrop, Layton walked through each of the administration’s main policy ideas for Fannie and Freddie, starting with President Donald Trump’s plan to have the two GSEs purchase $200 billion in mortgage-backed securities to push mortgage rates lower.

Layton acknowledged this move could modestly reduce mortgage rates while the purchases are being made, but he dismissed the magnitude of the effect, estimating the likely reduction in rates at 10 to 25 basis points at most.

Mortgage rates fell by 10 basis points after Trump announced the plan in January, and have since ticked higher, raising the possibility that any benefits of the bond purchases are already priced in.

Layton also criticized the tactic as a “mayonnaise approach” that would “spread around” any benefits equally to first-time buyers, second-home purchasers, and cash-out refi borrowers.

“First time homebuyers is clearly where the affordability rubber hits the road, where you want help the most,” he said. “So I consider this poor targeting—what percentage of the small benefit will actually make it to the people where you talk about affordability being the issue?”

Layton was similarly critical of proposals to cut the fees Fannie and Freddie charge investors to guarantee the timely payment of principal and interest on mortgage-backed securities, saying those fees are already structured to subsidize first-time buyers. Any cuts would mainly benefit wealthy second-home buyers or investors, he argued.

Similarly, Layton was dismissive of proposals to make GSE-backed mortgage rates assumable or portable, especially as a way to unlock the millions of 3% loans issued before rates jumped.

Layton noted that such changes would only apply to new mortgages, not existing loans, meaning it would take years before homebuyers would benefit from being able to transfer their rate to either a new owner or a new property.

Even if policymakers somehow retrofitted assumability to existing loans, he argued, real‑world evidence suggests the impact on affordability would be minimal. The FHA has long allowed assumptions, and yet of the nearly 8 million mortgages from the FHA, less than 6,000 have been assumed by a new owner.

“So this is one of these things where there’s a lot of discussion, but when you peel down, there’s not much there there,” says Layton.

Regarding 50-year mortgages, an idea already quietly discarded by the administration, Layton estimates that higher interest rates on the longer loans would make monthly payments nearly identical to 30-year loans, wiping out any benefit to the homebuyer.

Reducing closing costs seen as one bright spot

Although it is not a proposal that has received widespread attention, Layton was most positive about efforts to reduce upfront closing costs, which he described as a direct constraint on first‑time buyers.

Closing costs now typically range from 2% to 5% of the home price. With minimum down payments now much lower than the old 20% standard, those costs directly compete with down payments as the biggest strain on homebuyer savings.

“It was long cited that the biggest challenge to buying a home was, in fact, the upfront cash more than the monthly payment,” Layton said.

He pointed to long-standing evidence that key closing costs are not competitively priced, particularly title insurance, noting a Government Accountability Office study that questioned whether consumers were paying “reasonable” prices for title insurance in a market with limited competition.

Progress, however, has been slow and cautious, held back by intense industry pushback and regulators’ fear of congressional amendments that could leave the system worse than before.

Even so, Layton suggested this is the area where the GSEs and the Federal Housing Finance Agency can do the most immediate good for affordability, by pushing harder for reforms that make closing services more competitive and less costly.

“No one’s proposing this, but we have to put it out there,” says Layton. “If the FHFA got more aggressive on this, they could actually deliver pretty quickly a … moderately lower set of closing costs, which reduce the cash needed for upfront affordability.”