The perceived probability of a Federal Reserve interest rate cut next month has jumped dramatically after top officials closely allied with Fed Chair Jerome Powell expressed support for further rate cuts.

New York Fed President John Williams, a permanent voter and key voice on the rate-setting Federal Open Market Committee (FOMC), said on Nov. 21 that he sees room for interest rates to fall “in the near term.”

As well, San Francisco Fed President Mary Daly told the Wall Street Journal on Monday that she supports lowering interest rates at the next meeting. While Daly is not a voting member of the FOMC, she has rarely opposed Powell publicly, suggesting the Fed chair could seek a consensus in favor of cutting rates.

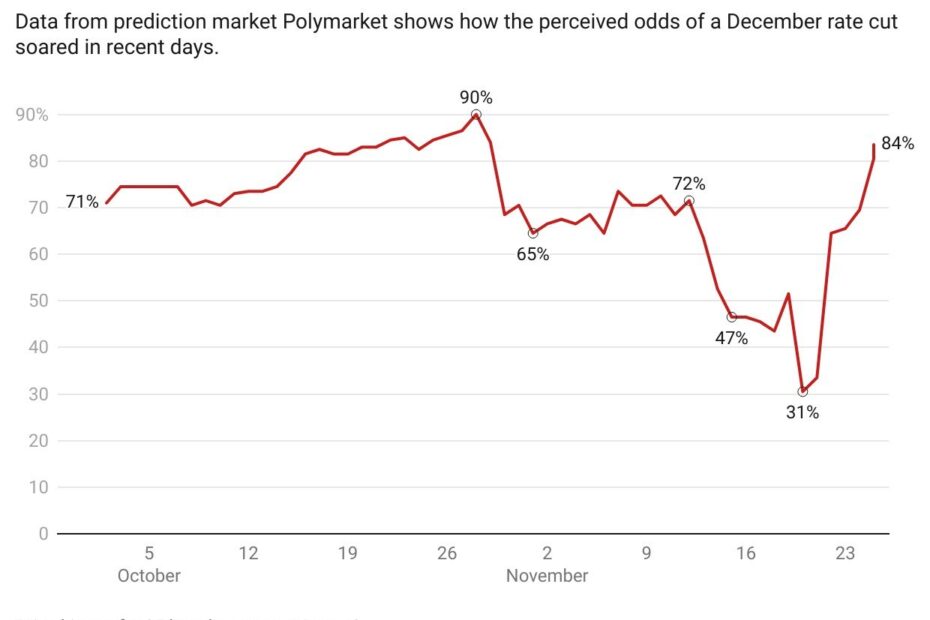

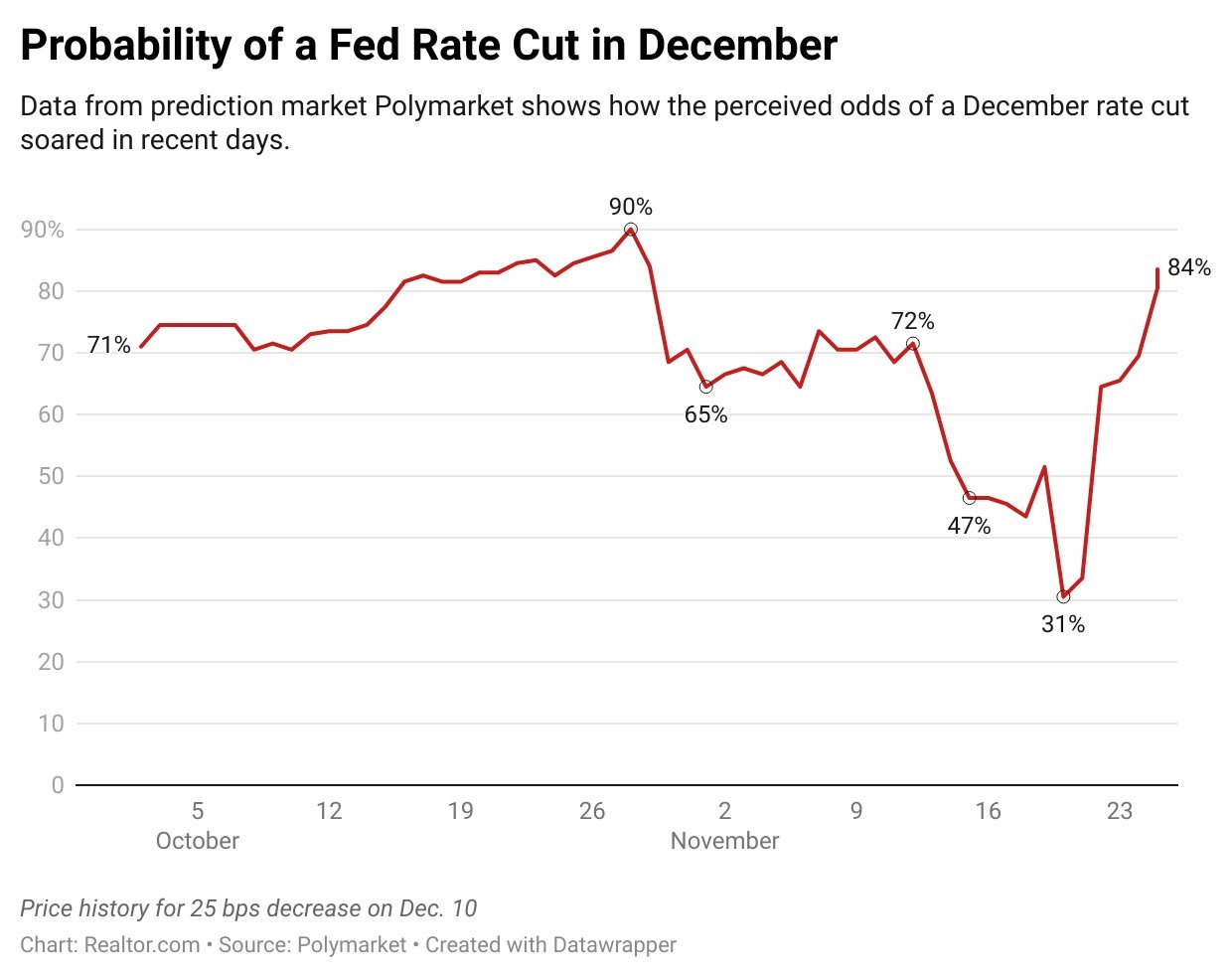

In financial and prediction markets, the probability of a quarter-point rate cut in December immediately surged, rising from a roughly 50-50 toss-up early last week to around 85% on Tuesday.

Still, stark divisions remain on the FOMC, with Boston Fed President Susan Collins and St. Louis Fed President Jeff Schmid both signaling that they will likely oppose a further rate cut this year, citing fears of lingering inflation.

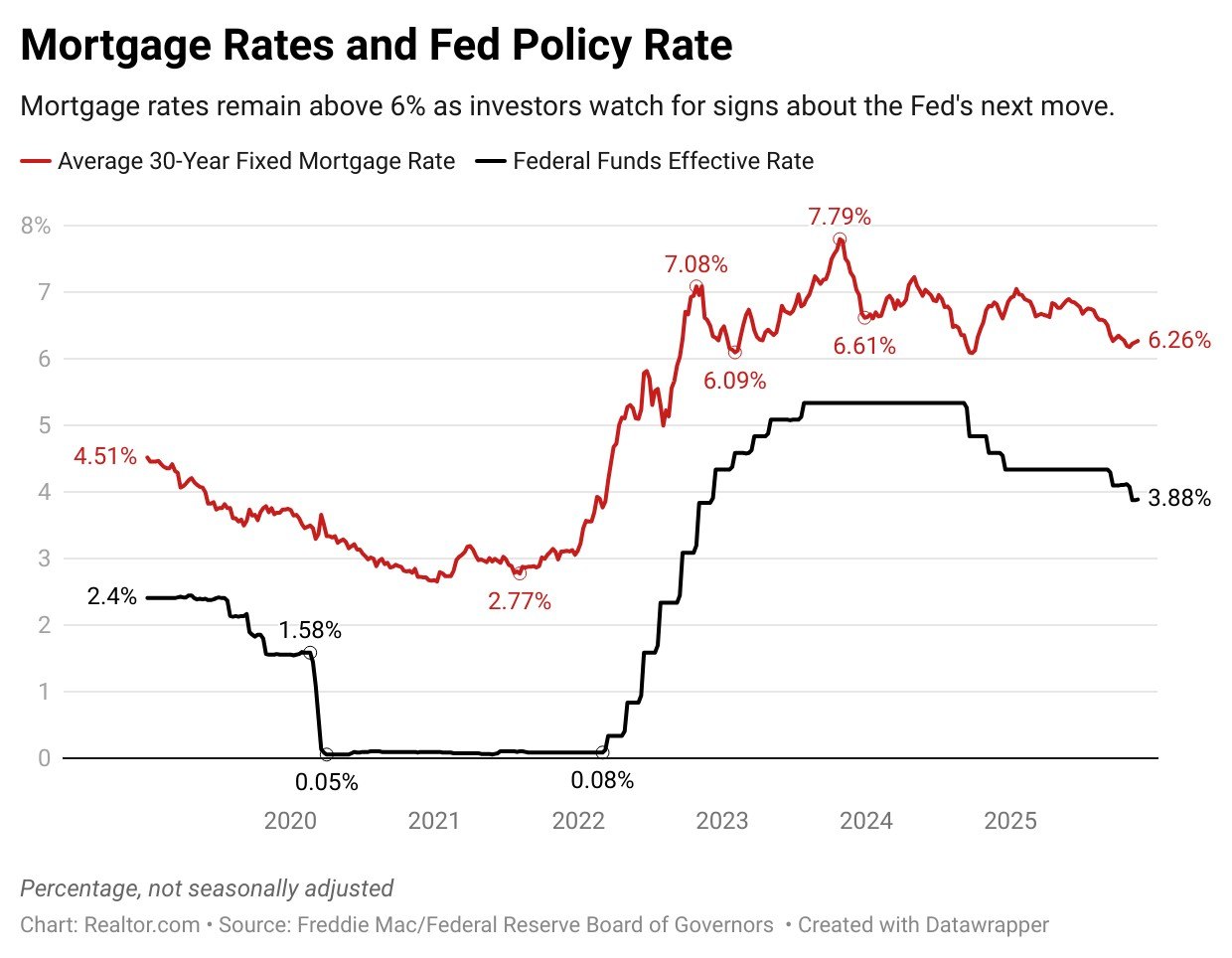

The Fed uses higher interest rates to fight inflation and lower rates to stimulate the labor market, in line with the central bank’s dual mandate of price stability and maximum employment. While the Fed doesn’t set mortgage rates directly, expectations about future Fed policy can influence those rates.

Earlier this fall, average mortgage rates fell to a one-year low of 6.17% in late October, just after the Fed cut its policy rate for the second consecutive meeting, taking it to a range of 3.75% to 4%.

The FOMC will next vote on rate policy on Dec. 10, with growing divisions of opinion among the panel’s members making the outcome unclear.

Williams, speaking at a conference at the Central Bank of Chile on Friday, offered the strongest endorsement yet for a December cut, offering a possible window into Powell’s thinking ahead of the meeting.

“I view monetary policy as being modestly restrictive,” said Williams. “Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral.”

Yields on 10-year Treasury notes, a key indicator for mortgage rates, eased following the comments, briefly dipping below 4% on Tuesday for the first time in nearly a month and signaling lower mortgage rates in the coming days.

“It’s hard to think of something that would reverse the momentum toward a cut we’ve seen this week, but there are still over two weeks until the meeting, which can be an eternity in this uncertain macro environment,” says Realtor.com® senior economist Jake Krimmel. “A few major FOMC voices would have to change their tune or some really troubling inflation/labor data would have to surface.”

New data paints a confusing economic picture

Meanwhile, a flurry of new data released this week offered conflicting signals about the state of the economy, potentially complicating the case for a rate cut.

Consumer confidence for November fell to its lowest level since April as Americans expressed worries about their future job prospects, inflation, and the overall economy.

The Consumer Confidence Index, calculated monthly by the Conference Board, plunged 7 points to 88.7 this month, down from 95.5 in October.

“Consumers were notably more pessimistic about business conditions six months from now,” says Dana Peterson, the Conference Board’s chief economist. “Mid-2026 expectations for labor market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings.”

Data on retail sales and wholesale inflation in September also came out on Tuesday, after a delay of several weeks due to the government shutdown.

Retail sales rose 0.2% in September, but after adjusting for the 0.3% increase in prices that month, real spending was actually down 0.1%.

Wholesale inflation also rose by 0.3% in September, keeping the annual pace of price increases at 2.7%, according to the Bureau of Labor Statistics. Wholesale price increases often filter through to consumers, and October’s consumer price index was up 3% annually, above the Fed’s 2% target.

The delayed data released on Tuesday offered only a partial and delayed picture of the economy, and additional key reports on employment and inflation are not expected before the Dec. 10 FOMC meeting.

Policymakers will have to rely on the September jobs report released last week, which showed stronger-than-expected job growth of 119,000, but an unemployment rate still elevated at 4.4%.

“The data drought may be formally over, but turning the faucet back on has only produced a trickle so far,” says Krimmel. “Because we won’t see a more timely jobs or CPI report until after the Fed meets, the only data they’ll have to go by will be from September. And that stale data is already functioning as a Rorschach test with the mixed jobs report providing ammo for hawks and doves alike.”