Top bond trader Rick Rieder has unexpectedly emerged as the leading contender to take over as chair of the Federal Reserve, after President Donald Trump called him a “very impressive” candidate.

Rieder, BlackRock’s chief investment officer of global fixed income, had previously been considered a long-shot candidate to replace Fed Chair Jerome Powell, whose term expires in May.

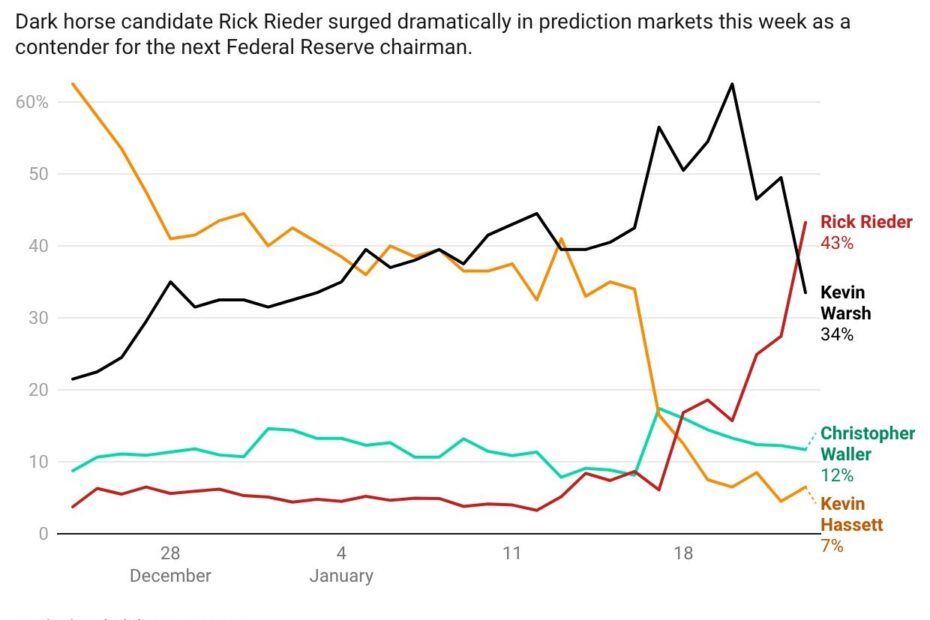

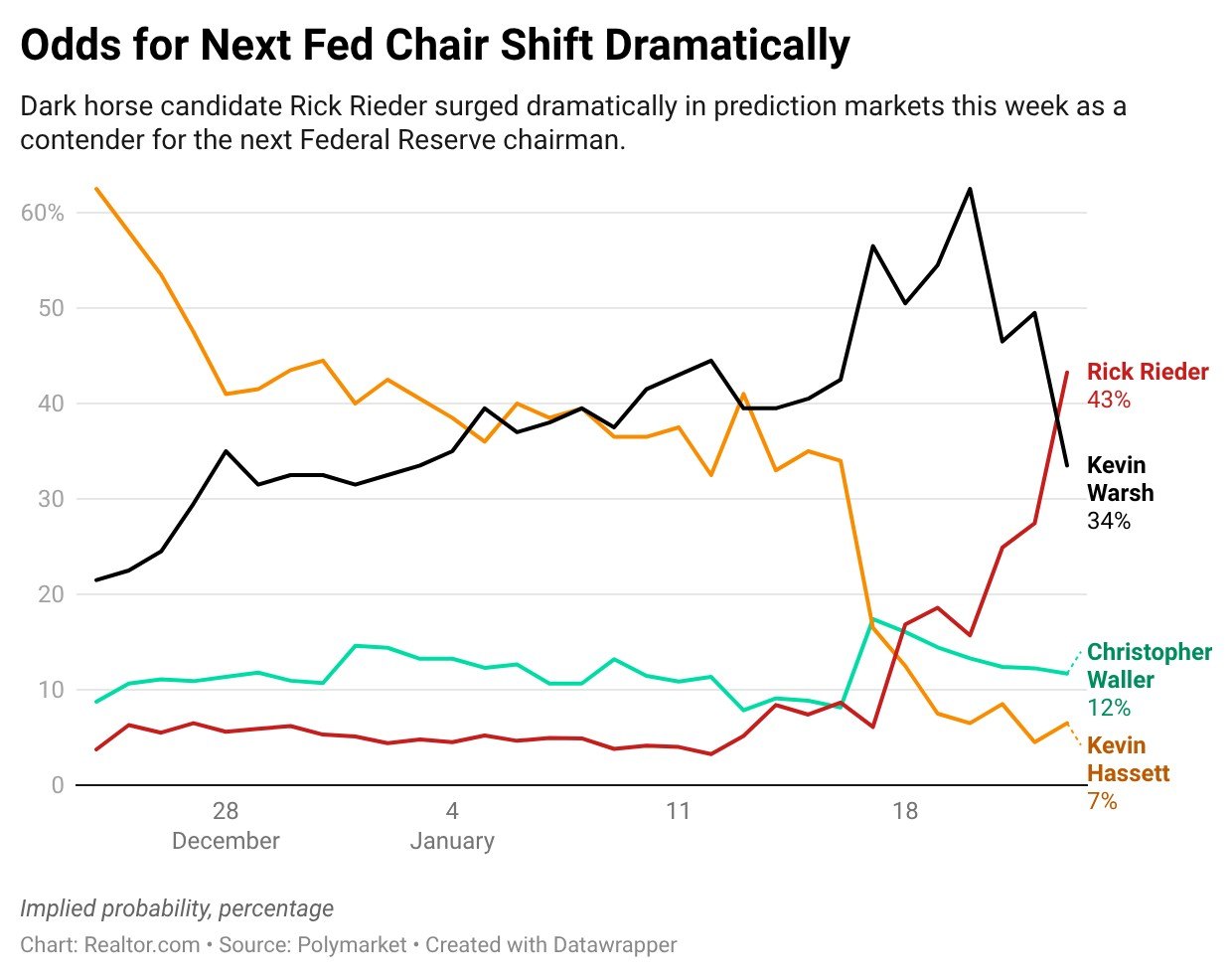

As recently as last week, prediction marketplace Polymarket ranked the probability of a Rieder chairmanship at just 3%. But on Friday afternoon, those odds jumped past 40%, putting him above former Fed Gov. Kevin Warsh as the leading contender.

Rieder’s dramatic surge as a dark horse candidate follows positive remarks from Trump and White House economic advisor Kevin Hassett, another finalist for the role, who called him “the best bond guy” in an interview with CNBC.

Hassett, Trump’s closest advisor on economic matters, had been considered the early frontrunner for Fed chair, but his odds have plunged following reports that the president may prefer him to remain in his current role.

Trump is expected to announce his nominee for Fed chair in the coming days, after telling reporters this week that he had reached a decision and would announce it “soon.”

What a Rieder Fed would mean for mortgage rates

Rieder is by far the most unconventional of the four remaining finalists to lead the Fed, and would bring a fresh perspective and deep expertise in bond markets to the central bank.

In public remarks, Rieder has been outspoken about the need for lower mortgage rates, which would reduce barriers for homebuyers and stimulate the housing market.

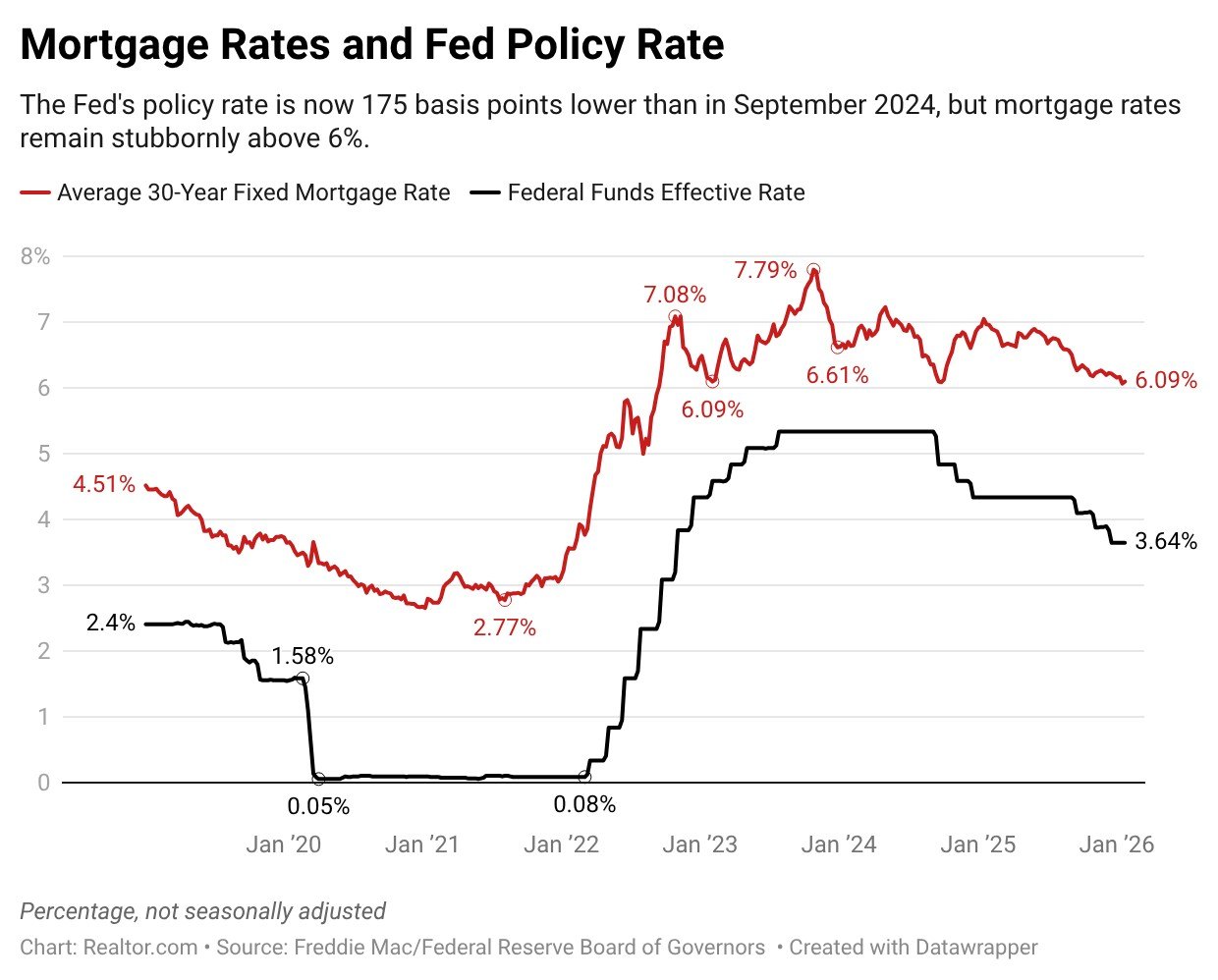

Rieder has said he believes the federal funds rate (currently at 3.5% to 3.75%) should be around 3%. He believes that committing to maintaining a fed funds rate below 4% would bring mortgage rates down to the mid-5% range (down from 6.09% now).

“You get the mortgage rate down, you create velocity of housing,” Rieder told Bloomberg Television last week. “It allows people to unlock value of their house. It allows labor mobility, because people can move.”

The Fed doesn’t control mortgage rates, but instead sets the overnight rate for lending between commercial banks. But among the finalists for Fed chair, Rieder is most optimistic about the Fed’s ability to creatively influence mortgage rates using the tools at its disposal.

“People said they have one tool, the fed funds rate. I find that incredibly superficial,” Rieder told Bloomberg. “You can use the balance sheet…you think about the size of the balance sheet relative to the duration, and you think about how you can be effective about using the long end of the curve.”

While Rieder has remained somewhat vague about his plans to influence mortgage rates, his comments seem to suggest an interest in strategically purchasing Treasury securities to achieve lower long-term yields, a tactic known as yield curve control (YCC).

Under YCC, the Fed effectively sets a price floor for certain bonds, stepping in to purchase them in bulk if the price falls below the critical threshold, which keeps interest rates on the securities from rising above a predetermined level.

YCC would offer a much more direct way for the Fed to influence mortgage rates, but the risks of that approach are well established from past experiences in the U.S., Japan, and Australia.

If investors perceive that the Fed is overly focused on suppressing longer-term yields to manage government financing costs, it could lead to a loss of confidence that the central bank will keep a lid on inflation.

Yield curve control also risks distorting valuable signals from the Treasury market, and can be a very difficult policy to exit, leading to violent gyrations in bond markets when the central bank ends its intervention.

“There are ways that the Fed could influence the long end of the curve with varying degrees of direct impact, such as adding longer-term bonds to the balance sheet in lieu of sticking strictly to short-term bills,” says Realtor.com® Chief Economist Danielle Hale. “The effectiveness of these methods is debated in the literature, but they may appeal to an administration that has been vocal about its desire to lower rates.”

The four finalists for Fed chair

In addition to Reider, Trump is considering Warsh, Hassett, and current Fed Gov. Chris Waller to replace Powell in May.

Michelle Bowman, another currently serving Fed governor, is no longer considered a viable candidate in prediction markets after making the initial short list compiled by Treasury Secretary Scott Bessent.

As of Jan. 23, Reider is the frontrunner on Polymarket, with a 43% chance of becoming the next Fed chair, followed by Warsh (34%), Waller (12%), and Hassett (7%).

Hassett, a close confidante of Trump, may have been particularly damaged by the fresh concerns over Fed independence that emerged earlier this month, after Powell accused Trump’s Justice Department of threatening criminal prosecution to coerce him to lower interest rates.

Senators, including some Republicans, responded angrily, threatening to block Trump’s nominee for Fed chair if they aren’t convinced the central bank will retain its independence under new leadership.

By law and tradition, the Fed is supposed to remain independent from political pressure, and long history has shown that keeping interest rates artificially low can wreak havoc in the economy.

Trump, who makes no secret of his desire for lower interest rates, has chafed at the concept of Fed independence, lamenting at Davos this week that his eventual choice for Fed chair may not end up slashing rates.

“Everyone that I interviewed is great. Everyone could do, I think, a fantastic job. Problem is they change once they get the job,” said Trump. “They get the job, and all of a sudden: ‘Let’s raise rates a little bit.’ I call them: ‘Sir, we’d rather not talk about this.’ It’s amazing how people change once they have the job. It’s too bad, sort of disloyalty, but they’ve got to do what they think is right.”