Recent blogs on digital marketing.

- Historic Spanish-Style Mansion Next to the Vice President’s Official Residence Hits the Market for $10.75 Million

A historic mansion that sits near the vice president’s official residence in Washington, DC’s exclusive Observatory Circle has hit the market for the first time in more than a decade—with an asking price of $10.75 million. The Heurich-Parks House offers many an impressive amenity, but it is the property’s unrivaled proximity to the vice president’s… Read More »Historic Spanish-Style Mansion Next to the Vice President’s Official Residence Hits the Market for $10.75 Million

A historic mansion that sits near the vice president’s official residence in Washington, DC’s exclusive Observatory Circle has hit the market for the first time in more than a decade—with an asking price of $10.75 million. The Heurich-Parks House offers many an impressive amenity, but it is the property’s unrivaled proximity to the vice president’s… Read More »Historic Spanish-Style Mansion Next to the Vice President’s Official Residence Hits the Market for $10.75 Million - Supermodel Kendall Jenner Opens Up the Doors to the Jaw-Dropping Closet Inside Her $9 Million Beverly Hills Home

Fashion superstar Kendall Jenner has proudly unveiled the awe-inspiring closet space inside her stunning Beverly Hills mansion, showing off the room in which she stores her incredible collection of designer items—including priceless one-off pieces, as well as clothing passed down by her mom, Kris Jenner, and sister Kim Kardashian. The 30-year-old model, who owns three… Read More »Supermodel Kendall Jenner Opens Up the Doors to the Jaw-Dropping Closet Inside Her $9 Million Beverly Hills Home

Fashion superstar Kendall Jenner has proudly unveiled the awe-inspiring closet space inside her stunning Beverly Hills mansion, showing off the room in which she stores her incredible collection of designer items—including priceless one-off pieces, as well as clothing passed down by her mom, Kris Jenner, and sister Kim Kardashian. The 30-year-old model, who owns three… Read More »Supermodel Kendall Jenner Opens Up the Doors to the Jaw-Dropping Closet Inside Her $9 Million Beverly Hills Home - EXCLUSIVE: ‘Maine Cabin Masters’ Star Chase Morrill Reveals How He’s Turning TV Business Into Lucrative Legacy for His Kids

“Maine Cabin Masters” star Chase Morrill has built a career out of helping families to restore their rustic properties so that they can be passed down to future generations—all while building his own legacy by training his children in the same trade. Morrill, 48, has mastered the art of modernizing aging cabins while maintaining their… Read More »EXCLUSIVE: ‘Maine Cabin Masters’ Star Chase Morrill Reveals How He’s Turning TV Business Into Lucrative Legacy for His Kids

“Maine Cabin Masters” star Chase Morrill has built a career out of helping families to restore their rustic properties so that they can be passed down to future generations—all while building his own legacy by training his children in the same trade. Morrill, 48, has mastered the art of modernizing aging cabins while maintaining their… Read More »EXCLUSIVE: ‘Maine Cabin Masters’ Star Chase Morrill Reveals How He’s Turning TV Business Into Lucrative Legacy for His Kids - Inside New York City’s First ‘White Box’ Sale Since 2021

A $15 million “white box” condo at a luxury Art Deco-style building on Manhattan’s Upper West Side has become the first white box sale in the city since 2021. Occupying the entire 46th floor of the luxury tower at 200 Amsterdam—Unit 46 was sold as “white box”—meaning that it essentially has no interior and is… Read More »Inside New York City’s First ‘White Box’ Sale Since 2021

A $15 million “white box” condo at a luxury Art Deco-style building on Manhattan’s Upper West Side has become the first white box sale in the city since 2021. Occupying the entire 46th floor of the luxury tower at 200 Amsterdam—Unit 46 was sold as “white box”—meaning that it essentially has no interior and is… Read More »Inside New York City’s First ‘White Box’ Sale Since 2021 - Senator Pitches American Dream Account To Help First-Time Homebuyers SaveSen. Rick Scott pitched allowing banks to create specialized accounts for people saving for a down payment on a home. The Florida Republican introduced a bill to create the American Dream Account, which would allow people to put money in a special savings account that is exempt from some taxes. Several states have their own… Read More »Senator Pitches American Dream Account To Help First-Time Homebuyers Save

- Florida Homeowners To See $650 Million Savings From Insurance Surcharge Ending 2 Years EarlyThe Florida Insurance Guaranty Association recently voted to terminate a 1% emergency assessment on all Florida homeowners and business property and casualty policies two years early. This is expected to save Florida homeowners and businesses up to $650 million over the next two years—or about $31 a year for the average homeowner. The assessment was… Read More »Florida Homeowners To See $650 Million Savings From Insurance Surcharge Ending 2 Years Early

- Luxury Buyers in New York City Snapped Up 43 Properties in a Week—the Most Contracts Since May 2025

The Manhattan luxury market was red hot for the week ending March 8. High-end buyers purchased 43 properties, at $4 million and above, in a week, according to the Olshan Luxury Market Report. The contract signings totaled 11 more than the prior week. The report reveals this is the largest total since the week of… Read More »Luxury Buyers in New York City Snapped Up 43 Properties in a Week—the Most Contracts Since May 2025

The Manhattan luxury market was red hot for the week ending March 8. High-end buyers purchased 43 properties, at $4 million and above, in a week, according to the Olshan Luxury Market Report. The contract signings totaled 11 more than the prior week. The report reveals this is the largest total since the week of… Read More »Luxury Buyers in New York City Snapped Up 43 Properties in a Week—the Most Contracts Since May 2025 - Airbnb Needs More Hosts for the World Cup and Will Pay You To Rent Out Your Home

As excitement builds for the 2026 FIFA World Cup, Airbnb host earnings are projected to total nearly $156 million for the event. Now, Airbnb is seeking new hosts to meet surging demand for short-term rental stays during the tournament. It’s offering new hosts a $750 reward for listing their home on Airbnb and hosting their first guests by… Read More »Airbnb Needs More Hosts for the World Cup and Will Pay You To Rent Out Your Home

As excitement builds for the 2026 FIFA World Cup, Airbnb host earnings are projected to total nearly $156 million for the event. Now, Airbnb is seeking new hosts to meet surging demand for short-term rental stays during the tournament. It’s offering new hosts a $750 reward for listing their home on Airbnb and hosting their first guests by… Read More »Airbnb Needs More Hosts for the World Cup and Will Pay You To Rent Out Your Home - Can I Buy a House With a 500 Credit Score?

Key Takeaways It’s possible to buy a house with a 500 credit score, though your loan options might be limited. FHA loans offer the best chance of approval for borrowers with a lower credit score. Due to the increased risk to lenders, borrowers will face higher interest rates and larger down payments. Buying a house… Read More »Can I Buy a House With a 500 Credit Score?

Key Takeaways It’s possible to buy a house with a 500 credit score, though your loan options might be limited. FHA loans offer the best chance of approval for borrowers with a lower credit score. Due to the increased risk to lenders, borrowers will face higher interest rates and larger down payments. Buying a house… Read More »Can I Buy a House With a 500 Credit Score? - 13 Lawn Care Tips to Fix Everyday Landscaping Problems

A healthy, green lawn does more than boost curb appeal. It also creates a welcoming outdoor space where you can relax, entertain, and enjoy time outside. Still, maintaining thick, healthy grass can be challenging. From stubborn weeds and patchy turf to pests and compacted soil, many homeowners deal with the same landscaping frustrations every year.… Read More »13 Lawn Care Tips to Fix Everyday Landscaping Problems

A healthy, green lawn does more than boost curb appeal. It also creates a welcoming outdoor space where you can relax, entertain, and enjoy time outside. Still, maintaining thick, healthy grass can be challenging. From stubborn weeds and patchy turf to pests and compacted soil, many homeowners deal with the same landscaping frustrations every year.… Read More »13 Lawn Care Tips to Fix Everyday Landscaping Problems - Can You Get a Mortgage on Land? Land Loan vs Mortgage Explained

Buying land can be an exciting step toward building a home, starting a business, or making a long-term investment. However, many buyers are surprised to learn that financing land works differently than financing a house. One of the most common questions people ask during the process is: can you get a mortgage on land? The… Read More »Can You Get a Mortgage on Land? Land Loan vs Mortgage Explained

Buying land can be an exciting step toward building a home, starting a business, or making a long-term investment. However, many buyers are surprised to learn that financing land works differently than financing a house. One of the most common questions people ask during the process is: can you get a mortgage on land? The… Read More »Can You Get a Mortgage on Land? Land Loan vs Mortgage Explained - 5 Home Staging Tips on a Budget: Affordable Ways to Make Your House Shine for Buyers

Selling your home doesn’t have to mean spending thousands of dollars on upgrades. With the right home staging tips on a budget, even small, affordable changes can make your space feel brighter, cleaner, and potentially speed up the selling process. In this Redfin and Angi article, we explore practical ways to stage your home using… Read More »5 Home Staging Tips on a Budget: Affordable Ways to Make Your House Shine for Buyers

Selling your home doesn’t have to mean spending thousands of dollars on upgrades. With the right home staging tips on a budget, even small, affordable changes can make your space feel brighter, cleaner, and potentially speed up the selling process. In this Redfin and Angi article, we explore practical ways to stage your home using… Read More »5 Home Staging Tips on a Budget: Affordable Ways to Make Your House Shine for Buyers - When is Your First Mortgage Payment Due After Closing?

Key takeaways Your first mortgage payment is usually due on the first of the month, one full month (30 days) after the closing date. Add 30 days to your closing date and find the first day of the next month. For example, if you close on June 15, your first payment is likely due on… Read More »When is Your First Mortgage Payment Due After Closing?

Key takeaways Your first mortgage payment is usually due on the first of the month, one full month (30 days) after the closing date. Add 30 days to your closing date and find the first day of the next month. For example, if you close on June 15, your first payment is likely due on… Read More »When is Your First Mortgage Payment Due After Closing? - Days on Market Real Estate: What It Means and How Buyers Can Use It to Their Advantage

Key Takeaways Days on market show how competitive a listing is: Days on market (DOM) measures how long a home takes to sell. The national median is about 66 days as of early 2026. Longer OM can create negotiation opportunities: Ifa home sits on the market longer than comparable listings, sellers may be more open… Read More »Days on Market Real Estate: What It Means and How Buyers Can Use It to Their Advantage

Key Takeaways Days on market show how competitive a listing is: Days on market (DOM) measures how long a home takes to sell. The national median is about 66 days as of early 2026. Longer OM can create negotiation opportunities: Ifa home sits on the market longer than comparable listings, sellers may be more open… Read More »Days on Market Real Estate: What It Means and How Buyers Can Use It to Their Advantage - The ‘Subscription’ Home: The Rise of the Luxury Real Estate Waiting ListThe ultra-wealthy are finding new ways to shop for their dream homes—they’re “subscribing” to developers and joining waiting lists instead. By joining a waiting list, buyers aren’t just waiting for a house: they are collaborating on bespoke finishes like Danish ash floors and Calacatta Viola marble before the home is even finished. Brooklyn-based luxury real… Read More »The ‘Subscription’ Home: The Rise of the Luxury Real Estate Waiting List

- Washington Prepares To Pass Bill To Allow More Housing in Commercial AreasWashington is preparing to pass a bill that would require cities to allow residential development in some commercial areas, a priority for Gov. Bob Ferguson. Washington’s Senate Bill 6026 would require cities with more than 30,000 residents to allow residential uses in areas zoned for commercial and mixed-use development. The bill passed the House on… Read More »Washington Prepares To Pass Bill To Allow More Housing in Commercial Areas

- Niagara Falls Is Hundreds of Miles From an Ocean but Still Tops This List of Popular Summer Places

As spring and summer near, investors are turning their attention to beach houses, hoping to profit from the wave of seasonal visitors booking Airbnb and other short-term rentals. You may not think of beaches when it comes to Niagara Falls, but it tops AirDNA’s list of beachy short-term rental (STR) investments. AirDNA—a firm that compiles… Read More »Niagara Falls Is Hundreds of Miles From an Ocean but Still Tops This List of Popular Summer Places

As spring and summer near, investors are turning their attention to beach houses, hoping to profit from the wave of seasonal visitors booking Airbnb and other short-term rentals. You may not think of beaches when it comes to Niagara Falls, but it tops AirDNA’s list of beachy short-term rental (STR) investments. AirDNA—a firm that compiles… Read More »Niagara Falls Is Hundreds of Miles From an Ocean but Still Tops This List of Popular Summer Places - Developer Buys Abandoned Resort in the Hudson Valley and Vows To Restore It to Its Glory Days

A developer hopes to bring the old magic back to an abandoned Catskills resort that was once considered iconic. The formerly majestic Nevele Grand Hotel (also known as Nevele Country Club) in Ulster County, NY, used to be an integral part of the postwar communities of summer hotels, resorts, and bungalow colonies that made up… Read More »Developer Buys Abandoned Resort in the Hudson Valley and Vows To Restore It to Its Glory Days

A developer hopes to bring the old magic back to an abandoned Catskills resort that was once considered iconic. The formerly majestic Nevele Grand Hotel (also known as Nevele Country Club) in Ulster County, NY, used to be an integral part of the postwar communities of summer hotels, resorts, and bungalow colonies that made up… Read More »Developer Buys Abandoned Resort in the Hudson Valley and Vows To Restore It to Its Glory Days - One of Palm Springs’ ‘Storied’ Rock Houses Hits the Market for $1.5 Million: ‘A Rare Treasure’

Palm Springs’ most recognizable housing stock consists mostly of midcentury modern ranches designed by storied architects that include Donald Wexler, Albert Frey, and Charles E. DuBois, and famous for their floor-to-ceiling windows, horizontal lines, and open floor plans. However, the area is also home to a handful of “rare and storied” properties that may be… Read More »One of Palm Springs’ ‘Storied’ Rock Houses Hits the Market for $1.5 Million: ‘A Rare Treasure’

Palm Springs’ most recognizable housing stock consists mostly of midcentury modern ranches designed by storied architects that include Donald Wexler, Albert Frey, and Charles E. DuBois, and famous for their floor-to-ceiling windows, horizontal lines, and open floor plans. However, the area is also home to a handful of “rare and storied” properties that may be… Read More »One of Palm Springs’ ‘Storied’ Rock Houses Hits the Market for $1.5 Million: ‘A Rare Treasure’ - Abandoned 1837 Church Is Transformed Into a Beautiful 37-Acre Catskills Retreat—Complete With a Bell Tower Library

An early 19th-century Greek Revival church that was left abandoned on two separate occasions has been “meticulously reimagined” into a stunning $3 million retreat in upstate New York. Spanning just over 37 acres at the foothills of the Catskill Mountains, the property retains its original 1837 timber frame, with exposed hand-hewn beams creating a dramatic… Read More »Abandoned 1837 Church Is Transformed Into a Beautiful 37-Acre Catskills Retreat—Complete With a Bell Tower Library

An early 19th-century Greek Revival church that was left abandoned on two separate occasions has been “meticulously reimagined” into a stunning $3 million retreat in upstate New York. Spanning just over 37 acres at the foothills of the Catskill Mountains, the property retains its original 1837 timber frame, with exposed hand-hewn beams creating a dramatic… Read More »Abandoned 1837 Church Is Transformed Into a Beautiful 37-Acre Catskills Retreat—Complete With a Bell Tower Library - 22-Foot-Wide Brooklyn Townhouse With Private Estate-Inspired Garden Lists for $7.8 Million

A modernized Brooklyn townhome located in the Boerum Hill Historic District with gorgeous park-like private garden has just hit the market for $7.8 million. Built in the 1850s by William Alexander and James Hughes, the 4,400-square-foot brick residence has been thoughtfully updated to preserve the home’s integrity while offering modern amenities. The property boasts a… Read More »22-Foot-Wide Brooklyn Townhouse With Private Estate-Inspired Garden Lists for $7.8 Million

A modernized Brooklyn townhome located in the Boerum Hill Historic District with gorgeous park-like private garden has just hit the market for $7.8 million. Built in the 1850s by William Alexander and James Hughes, the 4,400-square-foot brick residence has been thoughtfully updated to preserve the home’s integrity while offering modern amenities. The property boasts a… Read More »22-Foot-Wide Brooklyn Townhouse With Private Estate-Inspired Garden Lists for $7.8 Million - ‘I Built My Teens Their Own Tiny Homes in My Backyard’

Just before the COVID-19 pandemic, Victoria Neidhardt’s youngest daughter, then 10, asked a question that led her to trade their New York home for nomadic life. “Do you feel fulfilled?” Victoria had recently divorced and was living with her four kids in a 3,000-square-foot single-family home in New York. She and her kids were settled… Read More »‘I Built My Teens Their Own Tiny Homes in My Backyard’

Just before the COVID-19 pandemic, Victoria Neidhardt’s youngest daughter, then 10, asked a question that led her to trade their New York home for nomadic life. “Do you feel fulfilled?” Victoria had recently divorced and was living with her four kids in a 3,000-square-foot single-family home in New York. She and her kids were settled… Read More »‘I Built My Teens Their Own Tiny Homes in My Backyard’ - The Ultra-Luxury Market Heats Up in Jackson Hole—Here’s Why People Are Flocking to the Ski Town Year-Round

The Jackson Hole, WY, housing market has surpassed traditional luxury levels and entered ultra-luxury territory. The ultra-high-end market—defined as homes selling for $10 million or more and condos, townhomes, and single-family lots selling for $5 million or more—reported 131% more closings in 2025, according to the Jackson Hole Real Estate Report. The number of $10 million… Read More »The Ultra-Luxury Market Heats Up in Jackson Hole—Here’s Why People Are Flocking to the Ski Town Year-Round

The Jackson Hole, WY, housing market has surpassed traditional luxury levels and entered ultra-luxury territory. The ultra-high-end market—defined as homes selling for $10 million or more and condos, townhomes, and single-family lots selling for $5 million or more—reported 131% more closings in 2025, according to the Jackson Hole Real Estate Report. The number of $10 million… Read More »The Ultra-Luxury Market Heats Up in Jackson Hole—Here’s Why People Are Flocking to the Ski Town Year-Round - Britney Spears’ Friend Warns Pop Star Needs To ‘Get Out of Los Angeles’ After Her DUI Arrest

Britney Spears‘ former personal assistant has warned that the singer needs to “get out of Los Angeles” for the good of her mental health after she was arrested for a DUI near her California home. On March 4, the 44-year-old was arrested in Ventura County after driving “erratically” at a high speed, with officers noting… Read More »Britney Spears’ Friend Warns Pop Star Needs To ‘Get Out of Los Angeles’ After Her DUI Arrest

Britney Spears‘ former personal assistant has warned that the singer needs to “get out of Los Angeles” for the good of her mental health after she was arrested for a DUI near her California home. On March 4, the 44-year-old was arrested in Ventura County after driving “erratically” at a high speed, with officers noting… Read More »Britney Spears’ Friend Warns Pop Star Needs To ‘Get Out of Los Angeles’ After Her DUI Arrest - Kathy Hilton Is Sued by Woman Who Claims She Was Permanently Injured During Visit to Reality Star’s $28 Million Mansion

“The Real Housewives of Beverly Hills” star Kathy Hilton is being sued by a woman who claims that she sustained permanent injuries while paying a visit to the socialite’s opulent $28 million Los Angeles mansion. According to court documents obtained by TMZ, Hilton is being sued by a woman named Kimberly Heffington, who alleges in… Read More »Kathy Hilton Is Sued by Woman Who Claims She Was Permanently Injured During Visit to Reality Star’s $28 Million Mansion

“The Real Housewives of Beverly Hills” star Kathy Hilton is being sued by a woman who claims that she sustained permanent injuries while paying a visit to the socialite’s opulent $28 million Los Angeles mansion. According to court documents obtained by TMZ, Hilton is being sued by a woman named Kimberly Heffington, who alleges in… Read More »Kathy Hilton Is Sued by Woman Who Claims She Was Permanently Injured During Visit to Reality Star’s $28 Million Mansion - Jobs Slump and Mortgage Rate Jumps—but Housing Remains Resilient Heading Into Spring Selling Season

We saw a softer-than-expected February jobs report, with unemployment rising and employers shedding more than 90,000 jobs. One bright spot: Earnings growth continued, edging slightly higher. The softer report could mean more tension between the Fed’s two goals, especially if next week’s inflation readings are high. But I don’t expect it to change the March… Read More »Jobs Slump and Mortgage Rate Jumps—but Housing Remains Resilient Heading Into Spring Selling Season

We saw a softer-than-expected February jobs report, with unemployment rising and employers shedding more than 90,000 jobs. One bright spot: Earnings growth continued, edging slightly higher. The softer report could mean more tension between the Fed’s two goals, especially if next week’s inflation readings are high. But I don’t expect it to change the March… Read More »Jobs Slump and Mortgage Rate Jumps—but Housing Remains Resilient Heading Into Spring Selling Season - Turning an Inherited Home Into a Short-Term Rental: The Legal and Tax Traps To Watch ForInheriting a home can seem like a windfall—especially if it’s a beach house, a mountain cabin, or a tourist destination retreat. For a growing number of heirs, the next thought is obvious: Why not put it on Airbnb? If you had this idea, you wouldn’t be alone. The U.S. short-term rental (STR) market now counts… Read More »Turning an Inherited Home Into a Short-Term Rental: The Legal and Tax Traps To Watch For

- The ROI of a Show-Stopping Garden: 5 Blooms To Plant in March To Increase Curb Appeal by Memorial Day

Now that it’s March, spring and summer are finally within reach and believe it or not, there’s no better time to get to work on your garden. By choosing the right, quick-blooming plants, you can achieve an Instagram-worthy front yard by Memorial Day weekend. And if you plan to sell or refinance this summer, you’ll… Read More »The ROI of a Show-Stopping Garden: 5 Blooms To Plant in March To Increase Curb Appeal by Memorial Day

Now that it’s March, spring and summer are finally within reach and believe it or not, there’s no better time to get to work on your garden. By choosing the right, quick-blooming plants, you can achieve an Instagram-worthy front yard by Memorial Day weekend. And if you plan to sell or refinance this summer, you’ll… Read More »The ROI of a Show-Stopping Garden: 5 Blooms To Plant in March To Increase Curb Appeal by Memorial Day - America Faces Shortfall of 7.2 Million Affordable Rental HomesNo state in the union is coming close to building enough affordable housing to shelter all of those who need it, according to a new report from the National Low Income Housing Coalition. The NLIHC’s annual report on the state of affordable housing found a shortage of 7.2 million affordable and available rental homes for… Read More »America Faces Shortfall of 7.2 Million Affordable Rental Homes

- Here’s How To Snag a Midtown Manhattan Apartment for Only $900

The old adage “If it seems too good to be true, it probably is” doesn’t apply to a stunningly cheap apartment in Midtown Manhattan. An $857-a-month one-bedroom apartment in a luxury building where similar units start at $4,725 will go to the lucky winner of a New York City affordable housing lottery. The building, The… Read More »Here’s How To Snag a Midtown Manhattan Apartment for Only $900

The old adage “If it seems too good to be true, it probably is” doesn’t apply to a stunningly cheap apartment in Midtown Manhattan. An $857-a-month one-bedroom apartment in a luxury building where similar units start at $4,725 will go to the lucky winner of a New York City affordable housing lottery. The building, The… Read More »Here’s How To Snag a Midtown Manhattan Apartment for Only $900 - Kendall Jenner Proudly Shows Off Her Stunning Bathroom Transformation in Before-and-After Renovation Photos

Supermodel Kendall Jenner has proudly unveiled the jaw-dropping results of a gut renovation on a bathroom inside her California home—just three months after she revealed that she had completed work on a custom-built dwelling in Wyoming. Jenner, 30, who owns two homes in the Golden State and another remote property out West, took to her… Read More »Kendall Jenner Proudly Shows Off Her Stunning Bathroom Transformation in Before-and-After Renovation Photos

Supermodel Kendall Jenner has proudly unveiled the jaw-dropping results of a gut renovation on a bathroom inside her California home—just three months after she revealed that she had completed work on a custom-built dwelling in Wyoming. Jenner, 30, who owns two homes in the Golden State and another remote property out West, took to her… Read More »Kendall Jenner Proudly Shows Off Her Stunning Bathroom Transformation in Before-and-After Renovation Photos - HGTV Stars Keith Bynum and Evan Thomas Mark a Major Career Milestone—After Slamming Network for Axing Their Show

“Bargain Block” stars Keith Bynum and Evan Thomas are celebrating 10 years in business—months after their series was unceremoniously yanked off the air, a move that saw Bynum lash out at the network for putting his “entire business and life through the ringer.” HGTV sparked controversy in June when it was revealed that it was canceling several… Read More »HGTV Stars Keith Bynum and Evan Thomas Mark a Major Career Milestone—After Slamming Network for Axing Their Show

“Bargain Block” stars Keith Bynum and Evan Thomas are celebrating 10 years in business—months after their series was unceremoniously yanked off the air, a move that saw Bynum lash out at the network for putting his “entire business and life through the ringer.” HGTV sparked controversy in June when it was revealed that it was canceling several… Read More »HGTV Stars Keith Bynum and Evan Thomas Mark a Major Career Milestone—After Slamming Network for Axing Their Show - Ritz-Carlton, Houston Opens Up Luxury Residence Sales for the First Time, Starting at $3 Million

An iconic high-end hotel is ready to give the public a chance to own a piece of luxury with its new branded residence in Houston. The Ritz-Carlton Residences is the latest to announce its condominiums are available to purchase, but future owners shouldn’t expect to move in just yet. Public sales are now underway for… Read More »Ritz-Carlton, Houston Opens Up Luxury Residence Sales for the First Time, Starting at $3 Million

An iconic high-end hotel is ready to give the public a chance to own a piece of luxury with its new branded residence in Houston. The Ritz-Carlton Residences is the latest to announce its condominiums are available to purchase, but future owners shouldn’t expect to move in just yet. Public sales are now underway for… Read More »Ritz-Carlton, Houston Opens Up Luxury Residence Sales for the First Time, Starting at $3 Million - ‘Today’ Host Al Roker Shows Off Gym at His $6 Million New York Townhouse as He Recommits to Workout Routine

“Today” show star Al Roker has given fans a glimpse into the gym setup inside his $6 million New York City townhouse, while revealing how he is recommitting himself to a fitness routine. The 71-year-old weatherman, who underwent a gastric bypass in 2002 and then a knee replacement surgery in 2023, took to Instagram to… Read More »‘Today’ Host Al Roker Shows Off Gym at His $6 Million New York Townhouse as He Recommits to Workout Routine

“Today” show star Al Roker has given fans a glimpse into the gym setup inside his $6 million New York City townhouse, while revealing how he is recommitting himself to a fitness routine. The 71-year-old weatherman, who underwent a gastric bypass in 2002 and then a knee replacement surgery in 2023, took to Instagram to… Read More »‘Today’ Host Al Roker Shows Off Gym at His $6 Million New York Townhouse as He Recommits to Workout Routine - Jessica Simpson ‘Has Decided To Keep’ $18 Million Mansion She Shared With Ex Eric Johnson—1 Month After Delisting L.A. Home Again

Jessica Simpson has reportedly decided to hold on to the $17.9 million Los Angeles mansion she bought with her estranged spouse, Eric Johnson, who is understood to have moved out of the property in the wake of their split—seemingly reversing his wife’s plans to sell the opulent dwelling. Simpson, 45, and Johnson, 46, initially listed the… Read More »Jessica Simpson ‘Has Decided To Keep’ $18 Million Mansion She Shared With Ex Eric Johnson—1 Month After Delisting L.A. Home Again

Jessica Simpson has reportedly decided to hold on to the $17.9 million Los Angeles mansion she bought with her estranged spouse, Eric Johnson, who is understood to have moved out of the property in the wake of their split—seemingly reversing his wife’s plans to sell the opulent dwelling. Simpson, 45, and Johnson, 46, initially listed the… Read More »Jessica Simpson ‘Has Decided To Keep’ $18 Million Mansion She Shared With Ex Eric Johnson—1 Month After Delisting L.A. Home Again - ‘Hideous’ Public Outcry on Trump’s $400 Million White House Ballroom Forces Panel Reviewing Project To Push Vote Until April

Public outcry over President Donald Trump‘s $400 million White House ballroom project has forced the federal panel reviewing the plans to delay a vote until April. The National Capital Planning Commission was expected to hear more details about the ballroom project from the White House and those involved, then vote on the construction plans on… Read More »‘Hideous’ Public Outcry on Trump’s $400 Million White House Ballroom Forces Panel Reviewing Project To Push Vote Until April

Public outcry over President Donald Trump‘s $400 million White House ballroom project has forced the federal panel reviewing the plans to delay a vote until April. The National Capital Planning Commission was expected to hear more details about the ballroom project from the White House and those involved, then vote on the construction plans on… Read More »‘Hideous’ Public Outcry on Trump’s $400 Million White House Ballroom Forces Panel Reviewing Project To Push Vote Until April - Almost Half of Workers Today Want To Change Jobs This Year—but There’s a Costly Trade-Off for First-Time Buyers Seeking New Career Paths

There’s a Great Reimagination of careers poised to happen in 2026 and 43% of workers are preparing for the change by hopefully switching their careers this year, according to a new report by FlexJobs. But if you’re one of them and also want to buy your first home, you might want to think twice. Doing… Read More »Almost Half of Workers Today Want To Change Jobs This Year—but There’s a Costly Trade-Off for First-Time Buyers Seeking New Career Paths

There’s a Great Reimagination of careers poised to happen in 2026 and 43% of workers are preparing for the change by hopefully switching their careers this year, according to a new report by FlexJobs. But if you’re one of them and also want to buy your first home, you might want to think twice. Doing… Read More »Almost Half of Workers Today Want To Change Jobs This Year—but There’s a Costly Trade-Off for First-Time Buyers Seeking New Career Paths - PICTURED: The Very Humble Alabama Home Rob Rausch Bought for Just $101K—Months After Winning $220K ‘Traitors’ Jackpot

Reality star Rob Rausch‘s victory in the latest season of “The Traitors” might not have hit screens until January—but it seems the former “Love Island” bad boy was already busy investing his winnings in a new real estate purchase long before the public was made privy to his reality TV success. Rausch, 27, claimed a… Read More »PICTURED: The Very Humble Alabama Home Rob Rausch Bought for Just $101K—Months After Winning $220K ‘Traitors’ Jackpot

Reality star Rob Rausch‘s victory in the latest season of “The Traitors” might not have hit screens until January—but it seems the former “Love Island” bad boy was already busy investing his winnings in a new real estate purchase long before the public was made privy to his reality TV success. Rausch, 27, claimed a… Read More »PICTURED: The Very Humble Alabama Home Rob Rausch Bought for Just $101K—Months After Winning $220K ‘Traitors’ Jackpot - The Smart Home Technology That Could Actually Save Your Life

These days, smart home technology goes beyond convenience. The right tech—believe it or not—can actually prevent serious injuries and in some cases, death. “A few years ago, these technologies were seen as luxury items, but now they’re more accessible in terms of price, and you can even install most of them yourself,” explains Jason Reese,… Read More »The Smart Home Technology That Could Actually Save Your Life

These days, smart home technology goes beyond convenience. The right tech—believe it or not—can actually prevent serious injuries and in some cases, death. “A few years ago, these technologies were seen as luxury items, but now they’re more accessible in terms of price, and you can even install most of them yourself,” explains Jason Reese,… Read More »The Smart Home Technology That Could Actually Save Your Life - How to Reduce Indoor Allergies in Your Home: 5 Effective Ways

If you deal with indoor allergies, you know how frustrating it can be when symptoms flare up. Sneezing in your own bedroom or waking up congested isn’t just annoying, it can affect your sleep, productivity, and overall comfort. It doesn’t matter if you live in a house in Portland, OR, or are moving to a… Read More »How to Reduce Indoor Allergies in Your Home: 5 Effective Ways

If you deal with indoor allergies, you know how frustrating it can be when symptoms flare up. Sneezing in your own bedroom or waking up congested isn’t just annoying, it can affect your sleep, productivity, and overall comfort. It doesn’t matter if you live in a house in Portland, OR, or are moving to a… Read More »How to Reduce Indoor Allergies in Your Home: 5 Effective Ways - 7 Simple Ways to Prevent Water Damage in Older Homes

Older homes have charm you can’t easily recreate, from original hardwood floors to detailed trim work. But behind those beautiful features, aging plumbing and foundations can quietly increase the risk of costly water issues. Whether you’re paying off a mortgage or just maintaining your investment, water damage prevention matters even more in older properties. A… Read More »7 Simple Ways to Prevent Water Damage in Older Homes

Older homes have charm you can’t easily recreate, from original hardwood floors to detailed trim work. But behind those beautiful features, aging plumbing and foundations can quietly increase the risk of costly water issues. Whether you’re paying off a mortgage or just maintaining your investment, water damage prevention matters even more in older properties. A… Read More »7 Simple Ways to Prevent Water Damage in Older Homes - Counteroffers in Real Estate: A Buyer’s Guide to Smart Negotiation

Key Takeaways: A counteroffer means negotiations are still active. It’s an opportunity to refine terms and move closer to a deal. Review the entire contract, not just the price. Timelines, contingencies, and credits all affect the outcome. A knowledgeable buyer’s agent can help you evaluate risk, understand market conditions, and respond strategically. Buying a home… Read More »Counteroffers in Real Estate: A Buyer’s Guide to Smart Negotiation

Key Takeaways: A counteroffer means negotiations are still active. It’s an opportunity to refine terms and move closer to a deal. Review the entire contract, not just the price. Timelines, contingencies, and credits all affect the outcome. A knowledgeable buyer’s agent can help you evaluate risk, understand market conditions, and respond strategically. Buying a home… Read More »Counteroffers in Real Estate: A Buyer’s Guide to Smart Negotiation - Do You Need Preapproval to Make an Offer on a House?

If you’re ready to buy a home, you may be wondering: do you actually need a preapproval letter before submitting an offer? It’s a common question — especially in fast-moving markets where timing matters. The short answer is yes, you can technically make an offer without mortgage preapproval. There’s no rule preventing you from doing… Read More »Do You Need Preapproval to Make an Offer on a House?

If you’re ready to buy a home, you may be wondering: do you actually need a preapproval letter before submitting an offer? It’s a common question — especially in fast-moving markets where timing matters. The short answer is yes, you can technically make an offer without mortgage preapproval. There’s no rule preventing you from doing… Read More »Do You Need Preapproval to Make an Offer on a House? - The ‘Brady Bunch’ House Is Officially a Historic Landmark

The iconic “Brady Bunch” home has officially become a historic landmark after the Los Angeles City Council decided that the property was a cultural monument. From near and far, fans of the show have long traveled to the property to marvel at its near-identical resemblance to the abode that appears in the classic sitcom, taking… Read More »The ‘Brady Bunch’ House Is Officially a Historic Landmark

The iconic “Brady Bunch” home has officially become a historic landmark after the Los Angeles City Council decided that the property was a cultural monument. From near and far, fans of the show have long traveled to the property to marvel at its near-identical resemblance to the abode that appears in the classic sitcom, taking… Read More »The ‘Brady Bunch’ House Is Officially a Historic Landmark - Is Home Staging Still Worth It in the Age of AI?

In today’s AI era, sellers may wonder whether traditional home staging is still worth it. While the general consensus is that AI-generated staging is more affordable, experts agree it simply doesn’t deliver the same level of appeal and effectiveness as traditional staging. “It might get you clicks, but buyers are getting savvier at identifying what’s… Read More »Is Home Staging Still Worth It in the Age of AI?

In today’s AI era, sellers may wonder whether traditional home staging is still worth it. While the general consensus is that AI-generated staging is more affordable, experts agree it simply doesn’t deliver the same level of appeal and effectiveness as traditional staging. “It might get you clicks, but buyers are getting savvier at identifying what’s… Read More »Is Home Staging Still Worth It in the Age of AI? - The House That ‘ACOTAR’ Built: Inside $4 Million Mansion Sarah J. Maas Bought After Finding Fame With Wildly Popular Fantasy Series

Author Sarah J. Maas set the literary world alight when she was announced as the latest guest on Alex Cooper‘s popular “Call Her Daddy” podcast—sparking frantic speculation that she is set to announce a release date for the sixth book in her wildly popular “A Court of Thorns and Roses” series, which is more commonly… Read More »The House That ‘ACOTAR’ Built: Inside $4 Million Mansion Sarah J. Maas Bought After Finding Fame With Wildly Popular Fantasy Series

Author Sarah J. Maas set the literary world alight when she was announced as the latest guest on Alex Cooper‘s popular “Call Her Daddy” podcast—sparking frantic speculation that she is set to announce a release date for the sixth book in her wildly popular “A Court of Thorns and Roses” series, which is more commonly… Read More »The House That ‘ACOTAR’ Built: Inside $4 Million Mansion Sarah J. Maas Bought After Finding Fame With Wildly Popular Fantasy Series - House Passes Bill To Speed Up Mortgage Processes on Tribal Lands—and To Extend Leases to 99 YearsThe House passed a bill to simplify the mortgage process on tribal lands, setting it up for President Donald Trump to sign into law. The House voted 384-40 to pass S. 728, which would create new, faster deadlines for the Bureau of Indian Affairs to process residential and business mortgages on tribal land. The Senate… Read More »House Passes Bill To Speed Up Mortgage Processes on Tribal Lands—and To Extend Leases to 99 Years

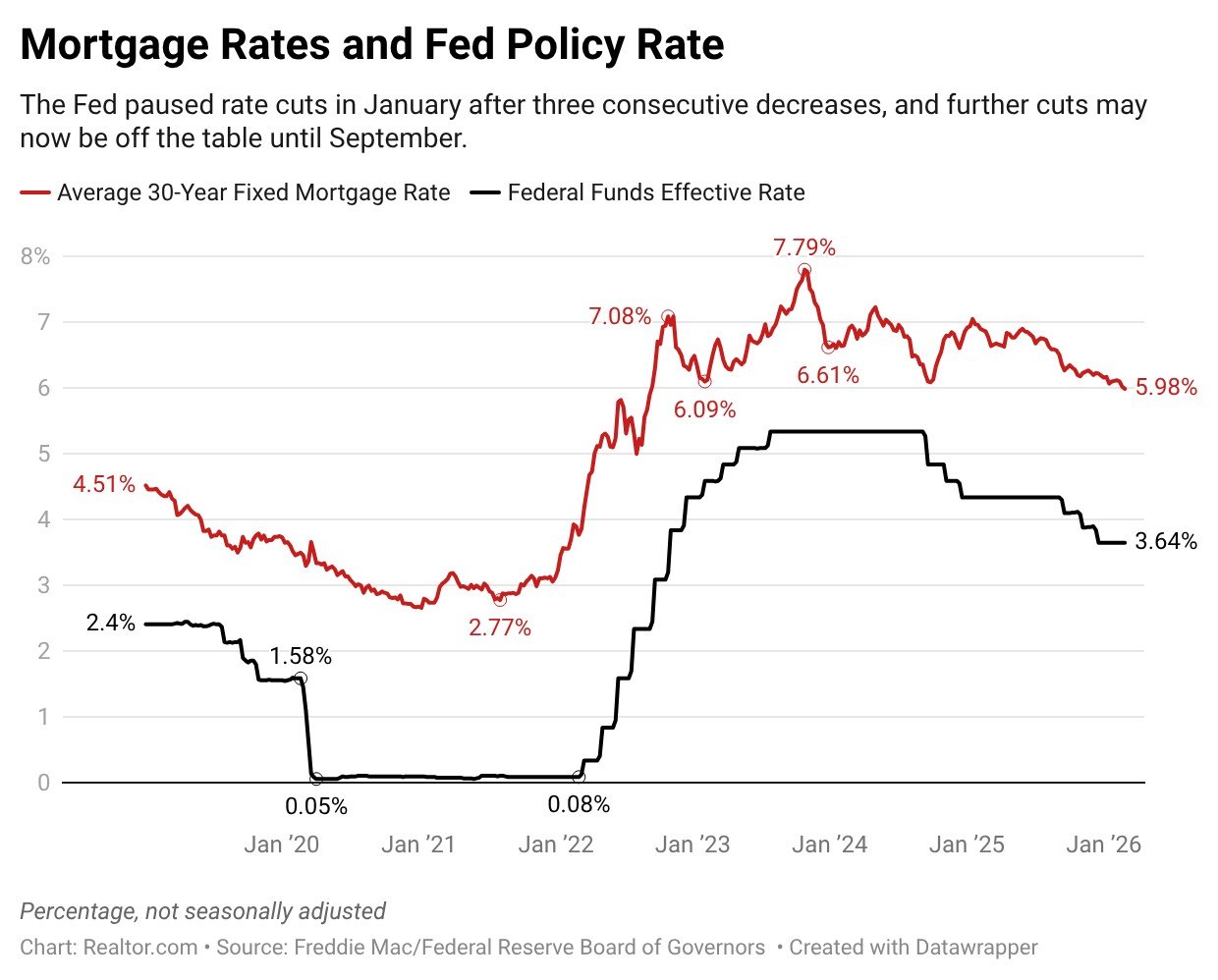

- Trump Officially Nominates Kevin Warsh for Fed Chair as Iran War Complicates Path for Rate Cuts

President Donald Trump has officially nominated Kevin Warsh to replace Jerome Powell as chairman of the Federal Reserve, but the widening U.S.-Israeli war with Iran is casting uncertainty over the swift interest rate cuts the president desires. Trump sent his nomination to the Senate on Wednesday, formally naming Warsh as his pick to lead the… Read More »Trump Officially Nominates Kevin Warsh for Fed Chair as Iran War Complicates Path for Rate Cuts

President Donald Trump has officially nominated Kevin Warsh to replace Jerome Powell as chairman of the Federal Reserve, but the widening U.S.-Israeli war with Iran is casting uncertainty over the swift interest rate cuts the president desires. Trump sent his nomination to the Senate on Wednesday, formally naming Warsh as his pick to lead the… Read More »Trump Officially Nominates Kevin Warsh for Fed Chair as Iran War Complicates Path for Rate Cuts - Andrew Mountbatten-Windsor Surrenders Another Royal Property—Less Than a Month After His Arrest in Jeffrey Epstein Probe

King Charles‘ brother, Andrew Mountbatten-Windsor, is set to hand back another of his rented royal properties—mere weeks after he was arrested on suspicion of misconduct in a public office over his ties to sex trafficker Jeffrey Epstein. Andrew, who was taken into custody for 11 hours on Feb 19., the date of his 66th birthday,… Read More »Andrew Mountbatten-Windsor Surrenders Another Royal Property—Less Than a Month After His Arrest in Jeffrey Epstein Probe

King Charles‘ brother, Andrew Mountbatten-Windsor, is set to hand back another of his rented royal properties—mere weeks after he was arrested on suspicion of misconduct in a public office over his ties to sex trafficker Jeffrey Epstein. Andrew, who was taken into custody for 11 hours on Feb 19., the date of his 66th birthday,… Read More »Andrew Mountbatten-Windsor Surrenders Another Royal Property—Less Than a Month After His Arrest in Jeffrey Epstein Probe - The Average 401(k) Balance Grew 11% in 2025: Why This Rally Is Lowering Default Risks for HomeownersAs the stock markets appeared to stabilize as the Middle East conflict entered its fifth day, another bit of good news reached those invested in trading. Analysis of nearly 25 million 401(k) accounts by Fidelity Investments shows the average balance rose a substantial 11% to $146,100, a significant gain despite market volatility in 2025. It… Read More »The Average 401(k) Balance Grew 11% in 2025: Why This Rally Is Lowering Default Risks for Homeowners

- EXCLUSIVE: $1.76 Billion Powerball Winner’s Former Mountain Cabin Home Lists for $250K—500 Yards From Where He Bought the Winning Ticket

The winner of a $1.76 billion Powerball jackpot is seeing his former California home up for sale just three months after he gifted the property to a not-for-profit. Theodorus Struyck bought his Frazier Park home back in 2010. He owned the property until December 2025, when he gifted it to the Triumph Foundation, according to… Read More »EXCLUSIVE: $1.76 Billion Powerball Winner’s Former Mountain Cabin Home Lists for $250K—500 Yards From Where He Bought the Winning Ticket

The winner of a $1.76 billion Powerball jackpot is seeing his former California home up for sale just three months after he gifted the property to a not-for-profit. Theodorus Struyck bought his Frazier Park home back in 2010. He owned the property until December 2025, when he gifted it to the Triumph Foundation, according to… Read More »EXCLUSIVE: $1.76 Billion Powerball Winner’s Former Mountain Cabin Home Lists for $250K—500 Yards From Where He Bought the Winning Ticket - Josh Duhamel Opens Up About Why He and Fergie Really Divorced—and What It’s Like To Co-Parent Their Son

Hollywood star Josh Duhamel has shed some light on why he and superstar Fergie divorced in 2019, admitting that their split was mostly due to their different outlooks on life. The “Life as We Know It” actor, 53, who was married to the “Fergalicious” singer from 2009 to 2019, candidly opened up about the reasoning… Read More »Josh Duhamel Opens Up About Why He and Fergie Really Divorced—and What It’s Like To Co-Parent Their Son

Hollywood star Josh Duhamel has shed some light on why he and superstar Fergie divorced in 2019, admitting that their split was mostly due to their different outlooks on life. The “Life as We Know It” actor, 53, who was married to the “Fergalicious” singer from 2009 to 2019, candidly opened up about the reasoning… Read More »Josh Duhamel Opens Up About Why He and Fergie Really Divorced—and What It’s Like To Co-Parent Their Son - Inside the Rebuilt Altadena Community Welcoming Back Homeowners a Year After the Eaton Fire

More than a year after the deadly Eaton fire scorched through Altadena, CA, the first homeowners are getting ready to move into a new residential community as the area continues to recover from the devastation. Construction on The Oak Grove of Altadena, a 16-home subdivision located on the north side of town, had wrapped up… Read More »Inside the Rebuilt Altadena Community Welcoming Back Homeowners a Year After the Eaton Fire

More than a year after the deadly Eaton fire scorched through Altadena, CA, the first homeowners are getting ready to move into a new residential community as the area continues to recover from the devastation. Construction on The Oak Grove of Altadena, a 16-home subdivision located on the north side of town, had wrapped up… Read More »Inside the Rebuilt Altadena Community Welcoming Back Homeowners a Year After the Eaton Fire - Beverly Hills ‘Queen of Real Estate’ Charged With Filing $568 Million in Phony Liens Against Unsuspecting Homeowners

A Beverly Hills woman who proclaimed herself the “queen of real estate” has been charged with filing dozens of fraudulent multimillion dollar liens against homeowners throughout Los Angeles County. Rita Cedeno Ortiz, 58, was arrested Feb. 26 and hit with 25 counts of aggravated felony forgery, according to booking and charging records obtained by Realtor.com®.… Read More »Beverly Hills ‘Queen of Real Estate’ Charged With Filing $568 Million in Phony Liens Against Unsuspecting Homeowners

A Beverly Hills woman who proclaimed herself the “queen of real estate” has been charged with filing dozens of fraudulent multimillion dollar liens against homeowners throughout Los Angeles County. Rita Cedeno Ortiz, 58, was arrested Feb. 26 and hit with 25 counts of aggravated felony forgery, according to booking and charging records obtained by Realtor.com®.… Read More »Beverly Hills ‘Queen of Real Estate’ Charged With Filing $568 Million in Phony Liens Against Unsuspecting Homeowners - 8,000 Historic Boston Buildings at Risk of Rotting Foundations: ‘Houses Are Built on Tree Trunks’There’s a hidden concern lurking beneath some of Boston’s priciest properties. Thousands of homes and buildings face structural risk as underground timber pilings deteriorate due to falling groundwater levels. Approximately 8,000 buildings built on filled land between the mid-1800s and early 1900s in Boston are possibly affected, Christian Simonelli, executive director of The Boston Groundwater… Read More »8,000 Historic Boston Buildings at Risk of Rotting Foundations: ‘Houses Are Built on Tree Trunks’

- Nearly 100-Year-Old Cape Cod Farmhouse Listed for $399,900 Sells in Just 10 Days

A Cape Cod, MA, farmhouse-style house that sold after only 10 days had been in the same family for over 90 years. The listing at 9 Oxbow Road in East Falmouth, built in the 1930s, had never had a renovation other than maintenance and some updates, so it not only retained its historical charm, but… Read More »Nearly 100-Year-Old Cape Cod Farmhouse Listed for $399,900 Sells in Just 10 Days

A Cape Cod, MA, farmhouse-style house that sold after only 10 days had been in the same family for over 90 years. The listing at 9 Oxbow Road in East Falmouth, built in the 1930s, had never had a renovation other than maintenance and some updates, so it not only retained its historical charm, but… Read More »Nearly 100-Year-Old Cape Cod Farmhouse Listed for $399,900 Sells in Just 10 Days - Lauren Sanchez Bezos Admits She Broke Down in Tears at the Prospect of Daughter Ella Leaving Home To Go to College

Lauren Sanchez Bezos is not even a year into her marriage to Amazon billionaire Jeff Bezos, but she’s already preparing to face another major life milestone—when her daughter, Ella, flies the family nest to attend college later this year. The 56-year-old former on-air correspondent, who tied the knot with Bezos, 62, in a multiday event… Read More »Lauren Sanchez Bezos Admits She Broke Down in Tears at the Prospect of Daughter Ella Leaving Home To Go to College

Lauren Sanchez Bezos is not even a year into her marriage to Amazon billionaire Jeff Bezos, but she’s already preparing to face another major life milestone—when her daughter, Ella, flies the family nest to attend college later this year. The 56-year-old former on-air correspondent, who tied the knot with Bezos, 62, in a multiday event… Read More »Lauren Sanchez Bezos Admits She Broke Down in Tears at the Prospect of Daughter Ella Leaving Home To Go to College - Why a Tax Extension Isn’t Smart for Homeowners in 2026The Internal Revenue Service (IRS) opened the tax filing season on Jan. 26, and the deadline for filing (without an extension) is April 15. For taxpayers requesting an extension, the deadline is Oct. 15, according to the IRS. And many Americans opt to delay filing their taxes, as 13% of Americans, or 20 million, take… Read More »Why a Tax Extension Isn’t Smart for Homeowners in 2026

- Housing Affordability Eclipses Crime as Chicago Residents’ No. 1 Concern

Housing affordability has emerged as Chicago residents’ top concern this year, overtaking crime and gun violence, according to a new poll. In a stark shift for the Windy City, 41% of the 648 registered voters who participated in an Illinois Realtors® survey conducted by the analytics firm Statara in January identified the cumulative burden of property… Read More »Housing Affordability Eclipses Crime as Chicago Residents’ No. 1 Concern

Housing affordability has emerged as Chicago residents’ top concern this year, overtaking crime and gun violence, according to a new poll. In a stark shift for the Windy City, 41% of the 648 registered voters who participated in an Illinois Realtors® survey conducted by the analytics firm Statara in January identified the cumulative burden of property… Read More »Housing Affordability Eclipses Crime as Chicago Residents’ No. 1 Concern - Billionaire’s $50 Million Turks and Caicos Mansion That Has Been Featured on Netflix and Bravo Heads to Auction—With No Reserve

A $50 million Turks and Caicos property that has been featured in an array of wildly popular reality TV shows, including Bravo’s “Real Housewives Ultimate Girls Trip” and Netflix’s “Too Hot to Handle” is set to hit the auction block next month—with no reserve. That means the property, which is currently on the market for… Read More »Billionaire’s $50 Million Turks and Caicos Mansion That Has Been Featured on Netflix and Bravo Heads to Auction—With No Reserve

A $50 million Turks and Caicos property that has been featured in an array of wildly popular reality TV shows, including Bravo’s “Real Housewives Ultimate Girls Trip” and Netflix’s “Too Hot to Handle” is set to hit the auction block next month—with no reserve. That means the property, which is currently on the market for… Read More »Billionaire’s $50 Million Turks and Caicos Mansion That Has Been Featured on Netflix and Bravo Heads to Auction—With No Reserve - Mauricio Umansky’s Sister Sues Their Father’s Ex-Girlfriend, Alleging Financial Elder Abuse and Demanding $400K in Damages

“Buying Beverly Hills” alum Mauricio Umansky‘s family is suing the ex-girlfriend of his father, Eduardo Umansky, alleging financial elder abuse. According to court records seen by TMZ, the suit was filed by real estate mogul Umansky’s sister, Sharon Umansky Bento, who acts as Eduardo’s conservator, against Simin Tabibnia, who the family claims spent more than… Read More »Mauricio Umansky’s Sister Sues Their Father’s Ex-Girlfriend, Alleging Financial Elder Abuse and Demanding $400K in Damages

“Buying Beverly Hills” alum Mauricio Umansky‘s family is suing the ex-girlfriend of his father, Eduardo Umansky, alleging financial elder abuse. According to court records seen by TMZ, the suit was filed by real estate mogul Umansky’s sister, Sharon Umansky Bento, who acts as Eduardo’s conservator, against Simin Tabibnia, who the family claims spent more than… Read More »Mauricio Umansky’s Sister Sues Their Father’s Ex-Girlfriend, Alleging Financial Elder Abuse and Demanding $400K in Damages - Ivana Trump’s New York Townhouse Finally Sells at a Massive Discount—More Than 3 Years After Socialite Died in the Home

Late socialite Ivana Trump‘s palatial New York City townhouse has finally found a buyer—more than three years after it was put on the market for $26.5 million. President Donald Trump‘s former spouse resided in the home for more than 10 years, and it was in the Upper East Side property where Ivana died at the… Read More »Ivana Trump’s New York Townhouse Finally Sells at a Massive Discount—More Than 3 Years After Socialite Died in the Home

Late socialite Ivana Trump‘s palatial New York City townhouse has finally found a buyer—more than three years after it was put on the market for $26.5 million. President Donald Trump‘s former spouse resided in the home for more than 10 years, and it was in the Upper East Side property where Ivana died at the… Read More »Ivana Trump’s New York Townhouse Finally Sells at a Massive Discount—More Than 3 Years After Socialite Died in the Home - The Four Seasons Launches New Push To Sell Remaining Condos That Have Sat Vacant in This Gulf State

Four Seasons Hotel and Private Residences New Orleans is trying a new marketing push for the first time in a bid to sell the last remaining condominiums that have sat vacant since the building welcomed its first residents four years ago. The empty condos make up nearly 30% of the units—none of which have seen… Read More »The Four Seasons Launches New Push To Sell Remaining Condos That Have Sat Vacant in This Gulf State

Four Seasons Hotel and Private Residences New Orleans is trying a new marketing push for the first time in a bid to sell the last remaining condominiums that have sat vacant since the building welcomed its first residents four years ago. The empty condos make up nearly 30% of the units—none of which have seen… Read More »The Four Seasons Launches New Push To Sell Remaining Condos That Have Sat Vacant in This Gulf State - For Homebuyers, the Neighborhood Grocery Bill Is Another New Closing Cost ConsiderationThe cost of buying a home has never stopped at the listing price. From mortgage fees to closing costs to insurance and maintenance, homebuyers have a laundry list of additional dollar amounts to consider and manage before, during, and after they close on a home. In 2026, savvy buyers will add the cost of living… Read More »For Homebuyers, the Neighborhood Grocery Bill Is Another New Closing Cost Consideration

- Mark Zuckerberg Buys Newly Built $170 Million ‘Billionaire Bunker’ Mansion in Record-Breaking Deal

Facebook founder Mark Zuckerberg has reportedly found himself a new base in the Sunshine State in the form of an extravagant $170 million megamansion on Miami’s famed “Billionaire Bunker” island—just three doors down from a staggering compound owned by fellow tech tycoon Jeff Bezos. According to the Wall Street Journal, the billionaire mogul is the… Read More »Mark Zuckerberg Buys Newly Built $170 Million ‘Billionaire Bunker’ Mansion in Record-Breaking Deal

Facebook founder Mark Zuckerberg has reportedly found himself a new base in the Sunshine State in the form of an extravagant $170 million megamansion on Miami’s famed “Billionaire Bunker” island—just three doors down from a staggering compound owned by fellow tech tycoon Jeff Bezos. According to the Wall Street Journal, the billionaire mogul is the… Read More »Mark Zuckerberg Buys Newly Built $170 Million ‘Billionaire Bunker’ Mansion in Record-Breaking Deal - The Popular Housing Structure That Stalls in Rhode Island’s Selling Market

Skyrocketing housing prices in Rhode Island are pushing homeownership out of reach for many prospective buyers. “The post-pandemic buying frenzy of 2021 and 2022 severely boosted home prices in Rhode Island as it did in much of the country,” says Joel Berner, senior economist at Realtor.com®. “Inventory was historically low in this period, and while… Read More »The Popular Housing Structure That Stalls in Rhode Island’s Selling Market

Skyrocketing housing prices in Rhode Island are pushing homeownership out of reach for many prospective buyers. “The post-pandemic buying frenzy of 2021 and 2022 severely boosted home prices in Rhode Island as it did in much of the country,” says Joel Berner, senior economist at Realtor.com®. “Inventory was historically low in this period, and while… Read More »The Popular Housing Structure That Stalls in Rhode Island’s Selling Market - Elisabeth Hasselbeck Offers Glimpse Into Her At-Home Prep for ‘The View’ Return—as She Sits In for Alyssa Farah Griffin

Conservative commentator Elisabeth Hasselbeck has revealed a tongue-in-cheek glimpse into her preparation for her latest round of appearances on “The View,” before traveling from her home in Nashville, TN, to New York City, where she is filling in for Alyssa Farah Griffin on the talk show. Hasselbeck, 48, will join the likes of Whoopi Goldberg… Read More »Elisabeth Hasselbeck Offers Glimpse Into Her At-Home Prep for ‘The View’ Return—as She Sits In for Alyssa Farah Griffin

Conservative commentator Elisabeth Hasselbeck has revealed a tongue-in-cheek glimpse into her preparation for her latest round of appearances on “The View,” before traveling from her home in Nashville, TN, to New York City, where she is filling in for Alyssa Farah Griffin on the talk show. Hasselbeck, 48, will join the likes of Whoopi Goldberg… Read More »Elisabeth Hasselbeck Offers Glimpse Into Her At-Home Prep for ‘The View’ Return—as She Sits In for Alyssa Farah Griffin - 28 Interior Design Tips to Make Your Home Feel Effortless—and Market-Ready

Effortless design isn’t about following trends—it’s about creating a home that just works. Whether you’re settling in or getting ready to sell, the right layout, lighting, and flow can make everyday life feel smoother and more inviting. Small, intentional choices can turn a house into a space that feels natural, comfortable, and undeniably stylish. In… Read More »28 Interior Design Tips to Make Your Home Feel Effortless—and Market-Ready

Effortless design isn’t about following trends—it’s about creating a home that just works. Whether you’re settling in or getting ready to sell, the right layout, lighting, and flow can make everyday life feel smoother and more inviting. Small, intentional choices can turn a house into a space that feels natural, comfortable, and undeniably stylish. In… Read More »28 Interior Design Tips to Make Your Home Feel Effortless—and Market-Ready - Big-Box Boom: The Clues That Signal Your Community Is About To Grow

When a major big-box retailer opens its doors in a community, it’s typically more than just a new place to shop—it’s a signal. These chains follow rising consumer demand, so their arrival often points to population growth, new residential construction, and a housing market on the upswing. “Big-box retailers typically target markets that are already… Read More »Big-Box Boom: The Clues That Signal Your Community Is About To Grow

When a major big-box retailer opens its doors in a community, it’s typically more than just a new place to shop—it’s a signal. These chains follow rising consumer demand, so their arrival often points to population growth, new residential construction, and a housing market on the upswing. “Big-box retailers typically target markets that are already… Read More »Big-Box Boom: The Clues That Signal Your Community Is About To Grow - From James Van Der Beek’s Family Ranch Buy to Nancy Guthrie’s Disappearance: February’s Biggest Celebrity News RevealedFebruary was a month dominated by poignant celebrity stories—from the tragic passing of beloved “Dawson’s Creek” star James Van Der Beek to the disappearance of “Today” host Savannah Guthrie‘s 84-year-old mother, Nancy, who vanished from her Arizona home on Feb. 1. Nancy was first reported missing hours after she is believed to have been abducted… Read More »From James Van Der Beek’s Family Ranch Buy to Nancy Guthrie’s Disappearance: February’s Biggest Celebrity News Revealed

- ‘I Left New York City and Invested $47K Upgrading a Tuff Shed Into a Tiny House in Kentucky’

When Sophie Goldie was working a consulting job in New York City, she never imagined life would lead her to call a $23,000 Tuff Shed in the wilds of Kentucky her forever home. But then, like so many others, the COVID-19 pandemic changed her plans. Her story takes her from the bustle of Manhattan to… Read More »‘I Left New York City and Invested $47K Upgrading a Tuff Shed Into a Tiny House in Kentucky’

When Sophie Goldie was working a consulting job in New York City, she never imagined life would lead her to call a $23,000 Tuff Shed in the wilds of Kentucky her forever home. But then, like so many others, the COVID-19 pandemic changed her plans. Her story takes her from the bustle of Manhattan to… Read More »‘I Left New York City and Invested $47K Upgrading a Tuff Shed Into a Tiny House in Kentucky’ - EXCLUSIVE: ‘Wild Vacation Rentals’ Stars Reveal the Biggest Red Flag To Look for When Booking a Getaway

Comedians Sherry Cola and D’Arcy Carden spend the night in dozens of distinctive rental homes to determine the most unique place for a getaway on their new HGTV series “Wild Vacation Rentals,” and they’re now coming clean about the most important room quality to check out before checking in. For each episode of the show,… Read More »EXCLUSIVE: ‘Wild Vacation Rentals’ Stars Reveal the Biggest Red Flag To Look for When Booking a Getaway

Comedians Sherry Cola and D’Arcy Carden spend the night in dozens of distinctive rental homes to determine the most unique place for a getaway on their new HGTV series “Wild Vacation Rentals,” and they’re now coming clean about the most important room quality to check out before checking in. For each episode of the show,… Read More »EXCLUSIVE: ‘Wild Vacation Rentals’ Stars Reveal the Biggest Red Flag To Look for When Booking a Getaway - Historic Gold-Dome-Topped Queen Anne Victorian Is Listed for $2.3 Million—120 Years After Surviving a Major Earthquake

San Francisco is known for its pastel-hued Queen Anne Victorians, which began popping up between the mid-1800s and early 1900s, as the city grew during the California Gold Rush, turning the area into a rainbow of elegant architecture. Though San Francisco has retained its reputation as a hub of design excellence, many of the original… Read More »Historic Gold-Dome-Topped Queen Anne Victorian Is Listed for $2.3 Million—120 Years After Surviving a Major Earthquake

San Francisco is known for its pastel-hued Queen Anne Victorians, which began popping up between the mid-1800s and early 1900s, as the city grew during the California Gold Rush, turning the area into a rainbow of elegant architecture. Though San Francisco has retained its reputation as a hub of design excellence, many of the original… Read More »Historic Gold-Dome-Topped Queen Anne Victorian Is Listed for $2.3 Million—120 Years After Surviving a Major Earthquake - The Rise of Cabin Culture—and the 10 Hottest Markets for Airbnb Investors

Rental cabins are having a moment. Much of the buzz traces back to the lake cottage featured on “Heated Rivalry,” which captured viewers’ imaginations and will soon be listed on Airbnb. Aaron Christy, founder of Indy Roof and Restoration, built three cabins in Norman, IN, in the middle of the woods. “Cabins are getting popular… Read More »The Rise of Cabin Culture—and the 10 Hottest Markets for Airbnb Investors

Rental cabins are having a moment. Much of the buzz traces back to the lake cottage featured on “Heated Rivalry,” which captured viewers’ imaginations and will soon be listed on Airbnb. Aaron Christy, founder of Indy Roof and Restoration, built three cabins in Norman, IN, in the middle of the woods. “Cabins are getting popular… Read More »The Rise of Cabin Culture—and the 10 Hottest Markets for Airbnb Investors - ‘Dementia Village’ in Wisconsin Will House Patients in ‘Main Street USA’ Setting

For millions of people living with dementia, quality of life often takes a drastic turn downward. But it doesn’t have to be that way. Agrace Hospice is planning a new village to be built in Madison, WI, that will house dementia patients in a “Main Street USA” setting. “We’ll restore a sense of autonomy and… Read More »‘Dementia Village’ in Wisconsin Will House Patients in ‘Main Street USA’ Setting

For millions of people living with dementia, quality of life often takes a drastic turn downward. But it doesn’t have to be that way. Agrace Hospice is planning a new village to be built in Madison, WI, that will house dementia patients in a “Main Street USA” setting. “We’ll restore a sense of autonomy and… Read More »‘Dementia Village’ in Wisconsin Will House Patients in ‘Main Street USA’ Setting - 1855 Savannah Landmark With Ties to Flannery O’Connor and Julia Roberts Is Listed for $5 Million

A distinguished Greek Revival landmark property in Savannah, GA, that boasts a rich 171-year history—including ties to A-list actress Julia Roberts and acclaimed author Flannery O’Connor—has hit the market for $4.95 million. Completed in 1855, the stately residence at 211 East Charlton St. overlooks Lafayette Square and offers a rare opportunity to own a piece… Read More »1855 Savannah Landmark With Ties to Flannery O’Connor and Julia Roberts Is Listed for $5 Million

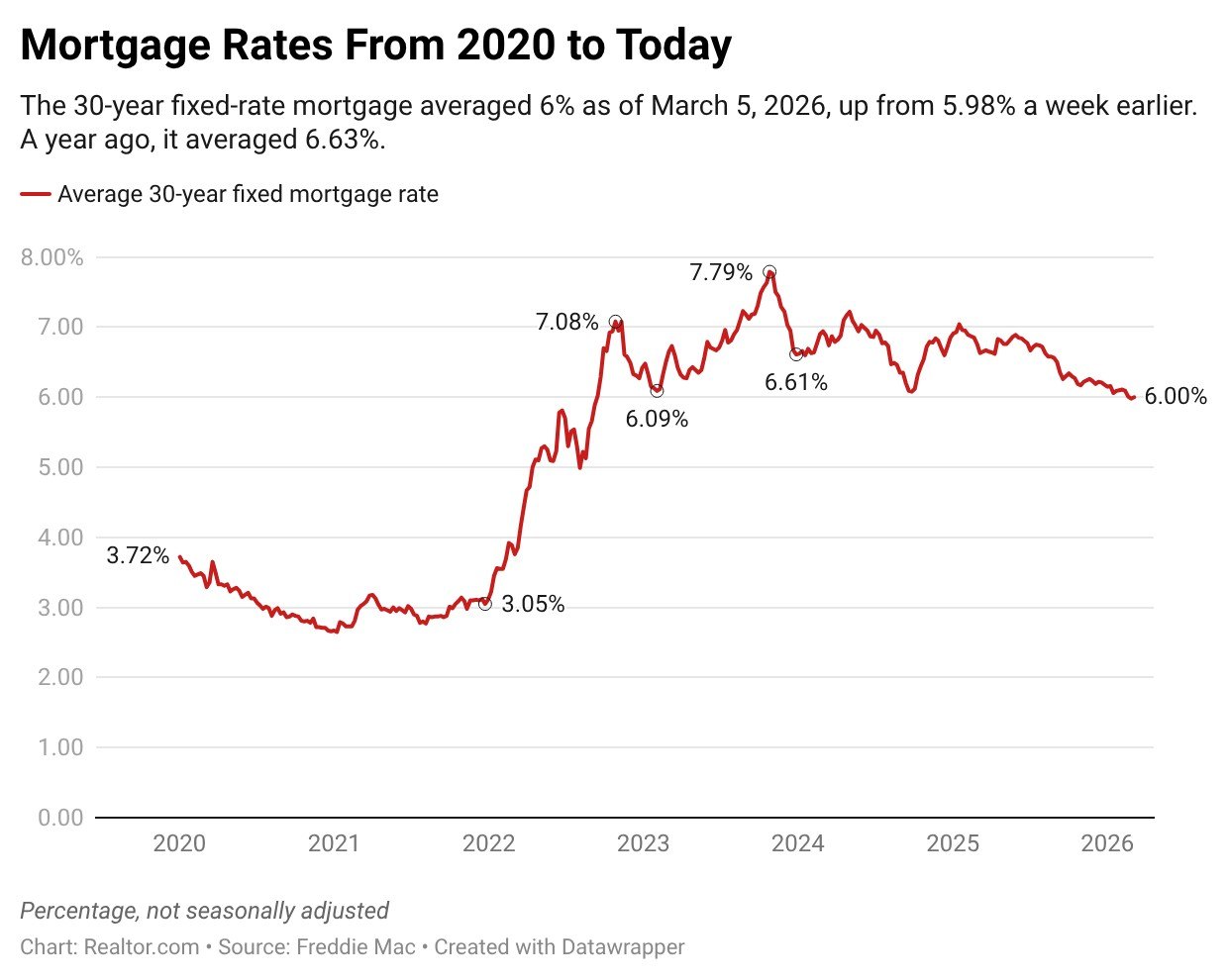

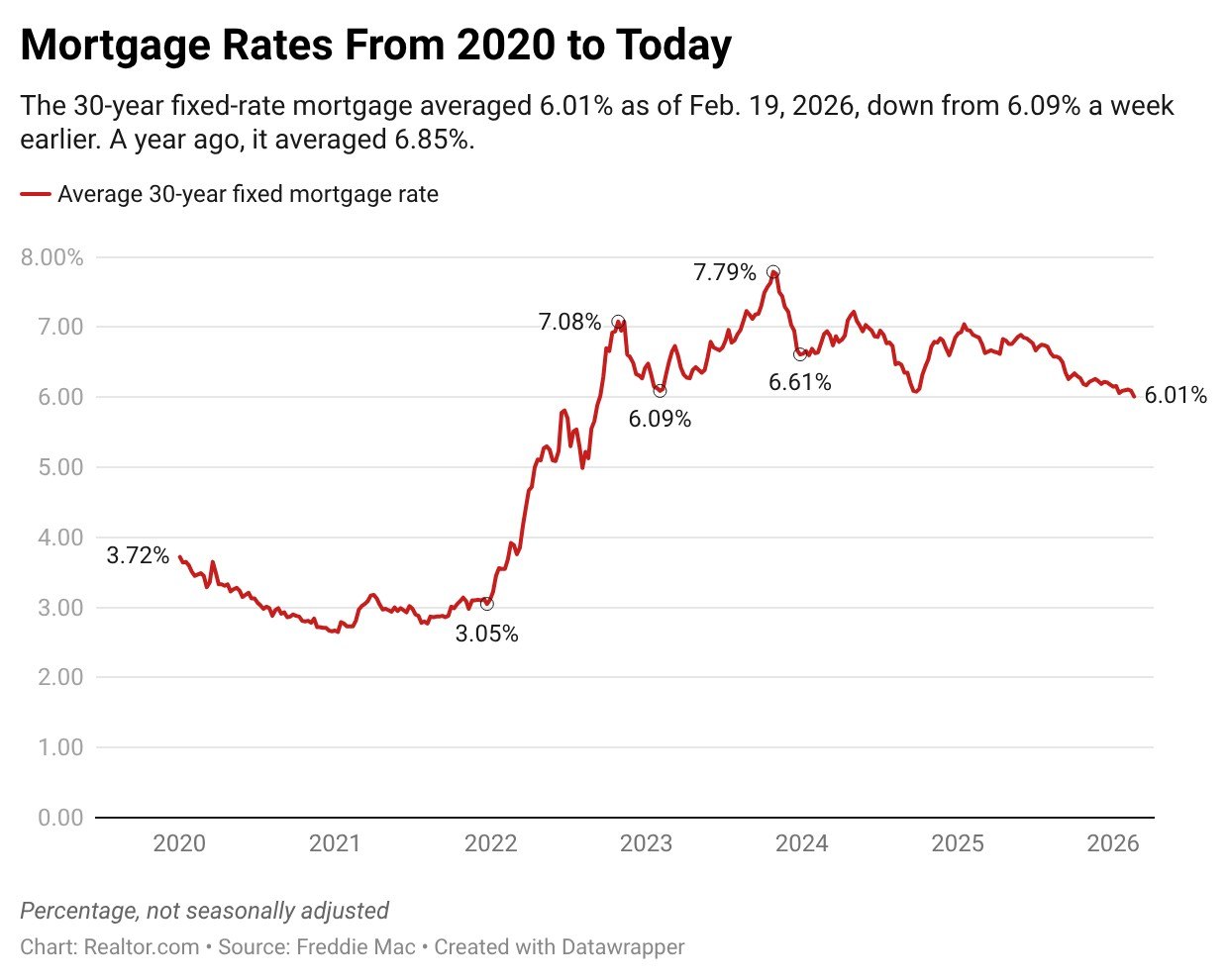

A distinguished Greek Revival landmark property in Savannah, GA, that boasts a rich 171-year history—including ties to A-list actress Julia Roberts and acclaimed author Flannery O’Connor—has hit the market for $4.95 million. Completed in 1855, the stately residence at 211 East Charlton St. overlooks Lafayette Square and offers a rare opportunity to own a piece… Read More »1855 Savannah Landmark With Ties to Flannery O’Connor and Julia Roberts Is Listed for $5 Million - March Kicks Off the Start of Homebuying Season: Are You Ready?As March arrives, so does peak homebuying season. With mortgage rates at a record low—dropping slightly below 6%—this spring is poised to be the perfect time to make an offer. “The weather isn’t the only thing that warms up come spring. March is really when things start to come back to life in the real… Read More »March Kicks Off the Start of Homebuying Season: Are You Ready?

- $10.5 Million Mansion Inside Disney’s Elite Golden Oak Community Boasts Cartoon-Themed Rooms and a Replica of Walt’s Office

It’s nigh on impossible to actually live the kind of fairy-tale life depicted in Disney’s iconic movies—yet one stunning mansion inside Walt Disney World’s infamously exclusive Golden Oak community will give one cartoon lover the chance to take one step closer to true magic. Golden Oak is a luxury residential community situated within the Walt Disney… Read More »$10.5 Million Mansion Inside Disney’s Elite Golden Oak Community Boasts Cartoon-Themed Rooms and a Replica of Walt’s Office

It’s nigh on impossible to actually live the kind of fairy-tale life depicted in Disney’s iconic movies—yet one stunning mansion inside Walt Disney World’s infamously exclusive Golden Oak community will give one cartoon lover the chance to take one step closer to true magic. Golden Oak is a luxury residential community situated within the Walt Disney… Read More »$10.5 Million Mansion Inside Disney’s Elite Golden Oak Community Boasts Cartoon-Themed Rooms and a Replica of Walt’s Office - EXCLUSIVE: Former NFL Player Finds Success Off the Field With New Career in Real Estate

Through hard work and dedication, Kendal Vickers got the chance to live out a dream shared by countless kids, through a seven-year career playing in the NFL. The 6-foot-3 defensive tackle carved out a pro career in one of the toughest roles in sports, suiting up for the Las Vegas Raiders from 2020 to 2022… Read More »EXCLUSIVE: Former NFL Player Finds Success Off the Field With New Career in Real Estate

Through hard work and dedication, Kendal Vickers got the chance to live out a dream shared by countless kids, through a seven-year career playing in the NFL. The 6-foot-3 defensive tackle carved out a pro career in one of the toughest roles in sports, suiting up for the Las Vegas Raiders from 2020 to 2022… Read More »EXCLUSIVE: Former NFL Player Finds Success Off the Field With New Career in Real Estate - The 10 Desirable Metros Where Buyers Can Still Snag a $300K Home

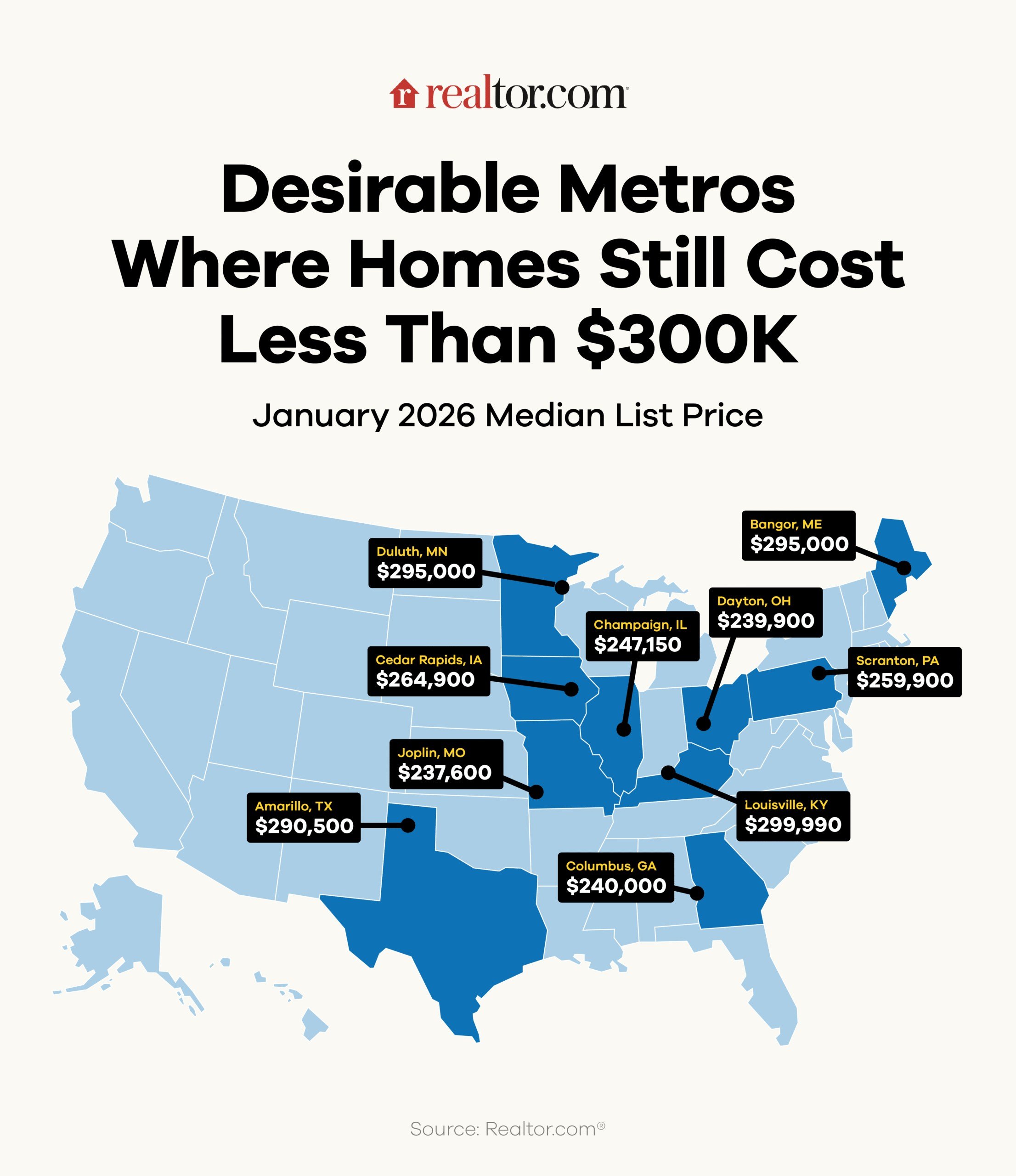

The math on homeownership doesn’t work in a lot of American cities anymore for many would-be homebuyers. Between high interest rates and a national median hovering around $399,900, homebuyers who refuse to be priced out are getting creative—and getting geographic. Realtor.com® identified 10 metros where you can still buy a home for less than $300,000… Read More »The 10 Desirable Metros Where Buyers Can Still Snag a $300K Home

The math on homeownership doesn’t work in a lot of American cities anymore for many would-be homebuyers. Between high interest rates and a national median hovering around $399,900, homebuyers who refuse to be priced out are getting creative—and getting geographic. Realtor.com® identified 10 metros where you can still buy a home for less than $300,000… Read More »The 10 Desirable Metros Where Buyers Can Still Snag a $300K Home - Alexander Brothers Still Face 10 Counts Linked to Sex Trafficking Despite Plan To Drop Some Charges

Federal prosecutors in New York are moving to drop some criminal counts against the Alexander brothers—two of them prominent ultra-luxury real estate agents—in their sex trafficking trial, citing concerns over suspected witness intimidation. “We don’t plan to proceed to the jury with counts 6 and 7,” Madison Smyser, an assistant U.S. attorney for the Southern… Read More »Alexander Brothers Still Face 10 Counts Linked to Sex Trafficking Despite Plan To Drop Some Charges

Federal prosecutors in New York are moving to drop some criminal counts against the Alexander brothers—two of them prominent ultra-luxury real estate agents—in their sex trafficking trial, citing concerns over suspected witness intimidation. “We don’t plan to proceed to the jury with counts 6 and 7,” Madison Smyser, an assistant U.S. attorney for the Southern… Read More »Alexander Brothers Still Face 10 Counts Linked to Sex Trafficking Despite Plan To Drop Some Charges - Mortgage Rates Below 6% Signal Shift in Housing Market—and Save Buyers a Full Monthly PaymentMortgage rates have fallen below 6% for the first time in more than two years—a psychological and financial milestone that could begin to thaw a housing market frozen by a prolonged high-rate era. The average rate dipped to 5.98% this week, its lowest level since September 2022. For buyers, that drop translates into meaningful savings:… Read More »Mortgage Rates Below 6% Signal Shift in Housing Market—and Save Buyers a Full Monthly Payment

- 6 Reasons Why It Makes Sense To Sell a Home Right Now—Before the Spring RushThinking about selling your house? While many home sellers wait until spring to put their property on the market, experts say there are advantages to listing sooner rather than later—especially this year. Alex Platt, a real estate broker in South Florida, says that last year, he advised many clients to list early in the year.… Read More »6 Reasons Why It Makes Sense To Sell a Home Right Now—Before the Spring Rush

- Larry Ellison Makes $173 Million Palm Beach Estate Near Trump’s Mar-a-Lago His Official Residence

Billionaire Oracle co-founder Larry Ellison has traded the Pacific for the Atlantic, shifting his primary residence from Hawaii to his $173 million estate in Palm Beach County, FL, sitting only a few miles from President Donald Trump‘s Mar-a-Lago club. The 81-year-old Ellison—whose $189.9 billion net worth makes him the world’s seventh-richest person, according to Forbes’… Read More »Larry Ellison Makes $173 Million Palm Beach Estate Near Trump’s Mar-a-Lago His Official Residence

Billionaire Oracle co-founder Larry Ellison has traded the Pacific for the Atlantic, shifting his primary residence from Hawaii to his $173 million estate in Palm Beach County, FL, sitting only a few miles from President Donald Trump‘s Mar-a-Lago club. The 81-year-old Ellison—whose $189.9 billion net worth makes him the world’s seventh-richest person, according to Forbes’… Read More »Larry Ellison Makes $173 Million Palm Beach Estate Near Trump’s Mar-a-Lago His Official Residence - If You Had An Extra 100 Square Feet of Pure Joy, What Would It Be?

- Tarek El Moussa Mocks Ex Christina Haack as He Takes Over Her Home: ‘The Blonde Chick Who Was Once My Wife’

HGTV star Tarek El Moussa has teasingly referred to his ex-wife, Christina Haack, as the “blonde chick who used to be my wife” while filming a promotional video in her home. El Moussa, 44, took to Instagram to share a hilarious “behind the scenes” video of himself filming at his ex-wife’s $12 million Newport Beach,… Read More »Tarek El Moussa Mocks Ex Christina Haack as He Takes Over Her Home: ‘The Blonde Chick Who Was Once My Wife’

HGTV star Tarek El Moussa has teasingly referred to his ex-wife, Christina Haack, as the “blonde chick who used to be my wife” while filming a promotional video in her home. El Moussa, 44, took to Instagram to share a hilarious “behind the scenes” video of himself filming at his ex-wife’s $12 million Newport Beach,… Read More »Tarek El Moussa Mocks Ex Christina Haack as He Takes Over Her Home: ‘The Blonde Chick Who Was Once My Wife’ - 6 Smart Moves Buyers Should Make Now That Mortgages Have Fallen Under 6%The average 30-year mortgage rate dropped to 5.98% on Feb. 26, marking the first time in three and a half years that the 30-year fixed-rate mortgage has dropped into the 5% range. This is momentous, given for the last two years, the “6% mark” has served as a psychological and financial barrier for millions of… Read More »6 Smart Moves Buyers Should Make Now That Mortgages Have Fallen Under 6%

- Authorities Identify ‘Weird’ Man Arrested Outside of Nancy Guthrie’s Home After He Drove Past the Property ’50 to 100 Times’

A man has been arrested outside of Nancy Guthrie‘s Arizona home on DUI charges—after he was seen driving past the property “50 to 100 times” while looking at a photo of the missing 84-year-old on his phone. Antonio De Jesus Pena-Campos, 34, was seen in a blue vehicle making his way past the $1 million… Read More »Authorities Identify ‘Weird’ Man Arrested Outside of Nancy Guthrie’s Home After He Drove Past the Property ’50 to 100 Times’

A man has been arrested outside of Nancy Guthrie‘s Arizona home on DUI charges—after he was seen driving past the property “50 to 100 times” while looking at a photo of the missing 84-year-old on his phone. Antonio De Jesus Pena-Campos, 34, was seen in a blue vehicle making his way past the $1 million… Read More »Authorities Identify ‘Weird’ Man Arrested Outside of Nancy Guthrie’s Home After He Drove Past the Property ’50 to 100 Times’ - Figure Skater Alysa Liu Is Given a Hero’s Welcome by Her California Hometown as She Returns From Winter Olympics

Figure skating icon Alysa Liu was given a very warm welcome when she jetted back to California after winning two gold medals at the 2026 Milan Winter Olympics—becoming the first American woman to claim victory in the individual event since 2002. The 20-year-old brought home the gold after pulling off a series of remarkable routines in… Read More »Figure Skater Alysa Liu Is Given a Hero’s Welcome by Her California Hometown as She Returns From Winter Olympics

Figure skating icon Alysa Liu was given a very warm welcome when she jetted back to California after winning two gold medals at the 2026 Milan Winter Olympics—becoming the first American woman to claim victory in the individual event since 2002. The 20-year-old brought home the gold after pulling off a series of remarkable routines in… Read More »Figure Skater Alysa Liu Is Given a Hero’s Welcome by Her California Hometown as She Returns From Winter Olympics - Which Niche Nook Fits Your Vibe?