Mortgage rates tumbled Thursday to a new 11-month low following a disappointing jobs report and alongside August inflation data, which could shape the Federal Reserve’s closely watched interest rate decision next week.

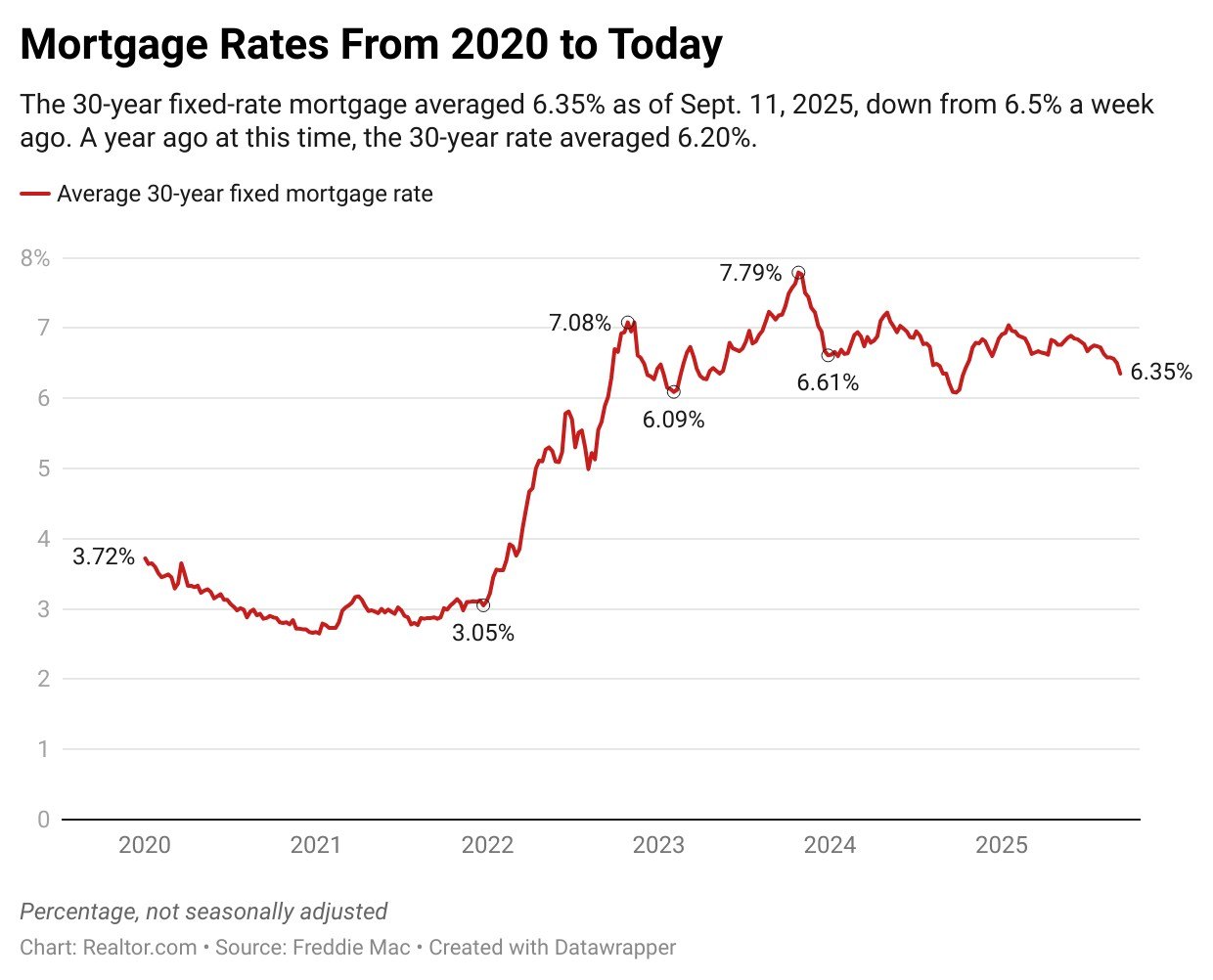

The average rate on 30-year fixed home loans was 6.35% for the week ending Sept. 11, down from 6.5% the previous week, according to Freddie Mac. Rates averaged 6.2% during the same period in 2024.

“The 30-year fixed-rate mortgage fell 15 basis points from last week, the largest weekly drop in the past year,” says Sam Khater, Freddie Mac’s chief economist. “Mortgage rates are headed in the right direction and homebuyers have noticed, as purchase applications reached the highest year-over-year growth rate in more than four years.”

The latest mortgage rate drop tracked the downward trend in 10-year Treasury yields, reflecting investors’ growing confidence that the Fed’s policymakers will cut the central bank’s key interest rate at their Federal Open Market Committee (FOMC) meeting on Sept. 17.

The likelihood of a rate reduction from its current range of 4.25% to 4.5%, which has been in place since Dec. 2024, increased even more after the Labor Department last week revealed that the unemployment rate in August ticked up to 4.3%, the highest in nearly four years.

At the same time, downward revised data from the Bureau of Labor Statistics showed that the economy added 911,00 fewer jobs in the year preceding March 2025 than originally reported.

On top of that, initial jobless claims climbed to the highest level since Oct. 2021, according to the latest report released Thursday morning, indicating further signs of a weakening economy—and putting additional pressure on the Fed as it seeks to balance its dual Congressional mandate of maximum employment and steady prices.

“The September decision may once again see dissent—not on whether to cut, but on how large the reduction should be, as some voting members may favor a bigger move to get ahead of the cooling labor market,” says Realtor.com® Economist Jiayi Xu.

Thursday’s Consumer Price Index (CPI) report showed that inflation rose to 2.9% in August, up from 2.7% the previous month, driven by surging prices on gas and groceries.

While a quarter-point cut to the benchmark federal funds rate is all but guaranteed, the latest jobs and inflation figures raise the question of whether the Fed’s policymakers might opt for a larger move next week, or signal additional cuts later this year.

“As the anticipated Fed rate cut approaches, mortgage rates have edged lower, providing some relief to active buyers and helping stabilize borrowing costs,” says Xu.

But the economist notes that the rate cut’s impact on overall market momentum is likely to be gradual, since 81% of homeowners hold mortgages below 6%, keeping rates too high to prompt most existing owners to sell and leaving inventory tight.

“Looking ahead, rates may stabilize or even rise slightly after the FOMC meeting, as markets—positioned for more aggressive easing—could be disappointed by the Fed’s guidance,” warns Xu.

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors in the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.